X-trader NEWS

Open your markets potential

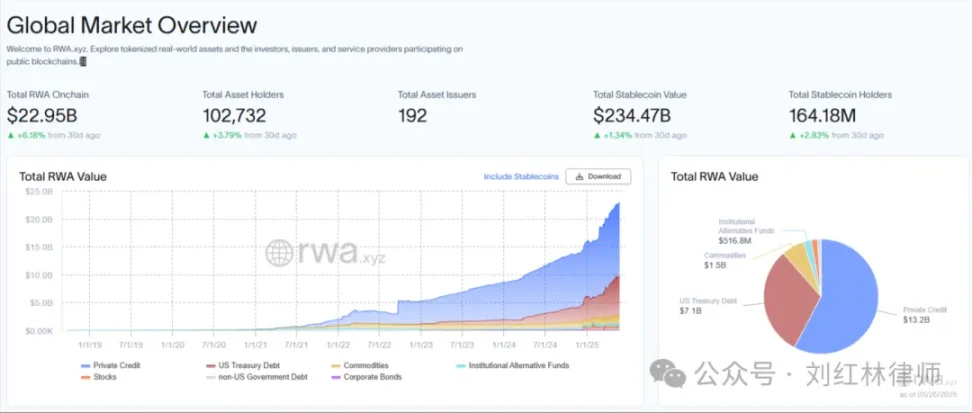

Analyze the securitization of RWA tokens and compare the current global regulatory status horizontally

What is RWA?

RWA (Real World Assets, tokenization of real - world assets) refers to the use of blockchain technology to convert physical assets in the real world (such as real estate, gold, artworks, etc.) or property rights (such as creditor's rights, usufruct, fund shares, etc.) into digital tokens that can circulate on the chain. It realizes an innovative model of asset segmentation, public ledgers, free circulation, and automated management. Its technical foundation relies on the immutability of the blockchain, the automatic execution capability of smart contracts, and needs to ensure the consistency of on - chain rights and the ownership of underlying assets through laws. In simple terms, RWA is very similar to asset securitization in traditional finance, but it is newer and more flexible. For example, suppose you own a house worth 3 million yuan. In reality, if you want to sell it, you may need to list the house on real estate agencies and channels like Anjuke.

For a period of time, you need to receive several potential buyers to view the house and communicate the price. After finally finding a buyer, you sell the whole house to the buyer, and the buyer needs to pay in full. This process has a long transaction cycle and complicated procedures. But if you use blockchain technology to convert this house into a digital token - house that can circulate on the chain, you divide the ownership of this 3 - million - yuan house into 30,000 house tokens, and each house token is worth 100 yuan, that is, each house token represents 1/30,000 of the ownership of the house. In this way, anyone can spend only 100 yuan to buy 1/30,000 of the ownership of the property and can freely buy and sell these tokens at any time - this is RWA. However, we all know that in mainland China, the change of real estate property rights requires going to the real estate registration center to handle the transfer. If the house is put on the chain to issue house tokens as in the above example, can you own the corresponding property right (real right) by buying this house token? Obviously not. This is obviously in conflict with Chinese laws. In fact, the core of RWA is not to move the asset itself onto the chain (the house can't be moved, and the equity can't be moved), but to tokenize the "equity voucher that proves you own the asset" - for example, convert legally recognized equity vouchers such as stocks, bonds, and property right certificates into Tokens on the chain. That is, the essence of an asset is a "right", and the carrier of the right is a "voucher recognized by law". What RWA needs to do is to repackage these "vouchers protected by law" using blockchain technology to make the circulation of vouchers more efficient and transparent, but the premise is: there are rights under the legal framework first, and then there are Tokens on the chain. Of course, it can be seen from here that the first step of RWA is tokenization - issuing RWA project tokens.

Securitization of RWA Tokens

(I) Classification of Tokens

When it comes to the securitization of RWA tokens, it is necessary to first understand the classification of cryptocurrencies. However, since countries, regions, and organizations around the world have not reached a unified classification standard, the current classification of cryptocurrencies is still in a chaotic state. The following lists the general classifications of cryptocurrencies in various regions of the world:

1. Hong Kong, China

The Hong Kong Securities and Futures Commission (Securities and Futures Commission, referred to as the SFC). In conjunction with the Hong Kong Monetary Authority (Hong Kong Monetary Authority), tokens are divided into security - type tokens and non - security - type tokens. Among them, security - type tokens are regulated by the Securities and Futures Ordinance, and non - security - type tokens are included in the supervision of the Anti - Money Laundering Ordinance.

2. Singapore

The Monetary Authority of Singapore (Monetary Authority of Singapore, referred to as "MAS") classifies cryptocurrencies into three categories, namely utility tokens, security - type tokens, and payment - type tokens. However, on March 27, 2025, the Monetary Authority of Singapore issued the "Consultation Paper on the Prudential Treatment of Cryptoasset Exposures and Requirements for Additional Tier 1 and Tier 2 Capital Instruments for Banks" (Consultation Paper on the Prudential Treatment of Cryptoasset Exposures and Requirements for Additional Tier 1 and Tier 2 Capital Instruments for Banks), intending to align the classification of crypto assets with the Basel standards.

3. United States

The United States classifies tokens into commodities and securities and has not yet made a more detailed classification of cryptocurrencies. The Commodity Futures Trading Commission (CFTC) of the United States has clearly classified Bitcoin and Ethereum as commodities. The Securities and Exchange Commission (SEC) uses the "Howey Test" to determine whether a certain asset is a security. However, there is a regulatory conflict between the SEC and the CFTC regarding the controversial focus of whether cryptocurrencies are "securities" or "commodities".

The Howey Test is a legal standard used by the SEC and courts to determine whether a transaction constitutes a "security" (especially an "investment contract").

According to the Howey Test, if a transaction meets the following four conditions, it is regarded as a "security" and must comply with U.S. securities laws:

a) An investment by one party

b) The investment is directed at a specific enterprise

c) The investment expects to make a profit

d) The generation of profits comes from the efforts of the issuer or a third party

In 2019, the U.S. Securities and Exchange Commission ruled that Bitcoin failed the Howey Test. According to the ruling, Bitcoin only meets the first item of this framework, that is, there must be a capital investment. However, since there is no central company controlling Bitcoin, the SEC ruled that Bitcoin does not meet the other requirements of the Howey Test: investors do not pool their funds into a "joint enterprise", and the value of Bitcoin does not depend on a third party (that is, the product developer).

4. European Union

The EU's Markets in Crypto - assets (MiCA) Regulation classifies crypto - assets into electronic money tokens, asset - referenced tokens, and other crypto - assets. It is worth mentioning that the EU classifies the stablecoins we often talk about into two categories, namely electronic money tokens and asset - referenced tokens.

5. Basel Committee

The Basel Committee on Banking Supervision (BCBS) is the primary global standard - setter for the prudential regulation of banks and provides a platform for regular cooperation on banking supervisory matters. Its 45 members include central banks and bank supervisory authorities from 28 jurisdictions. The Basel Framework it issues is the full set of standards of the Basel Committee on Banking Supervision (BCBS). Members of the BCBS have agreed to fully implement these standards and apply them to the internationally active banks within their jurisdictions. The SCO60 - Cryptoasset Exposures it issued classifies cryptoassets into the following categories:

### (II) Why Securitize RWA Tokens?

As mentioned earlier, although there is no unified standard for the classification of tokens in major global regions yet, there is a classification of security - type tokens in Hong Kong, China, Singapore, and the United States.

So the question arises: What type does the RWA token belong to?

In fact, the classification of RWA tokens should be based on their real - world assets:

A small number of RWA tokens belong to non - security - type tokens. For example, USDT and USDC, which dominate the stablecoin market, are both products of tokenizing the real - world asset of the US dollar. It can be said that USDT and USDC also belong to RWA, but they are definitely not security - type tokens.

Most RWA tokens belong to security - type tokens. For example, BlackRock's tokenized fund BUIDL. If you invest $1,000 in the BUIDL fund, the fund promises to provide a stable value of $1 per token and can help the holder manage finances so that the holder can obtain investment income.

Since most RWA tokens may belong to security - type tokens, they must be securitized (the tokens are recognized as securities). This means that these RWA tokens must comply with the securities regulatory policies of the regions where they circulate. Otherwise, once deemed non - compliant, there will be at least huge fines and at most criminal risks.

### Global Regulatory Landscape of RWA Tokens

At this stage, there are no specialized subdivided regulatory policies for RWA tokens. RWA tokens are essentially crypto assets, and the regulatory policies and regulations for crypto assets in various regions still apply to their supervision.

#### (I) Hong Kong, China

The regulatory draft for RWA stable tokens in Hong Kong was formally passed on May 21, 2025, and it deeply discussed the compliance framework and regulatory possibilities of RWA stable tokens from 8 key points. They are:

1. Licensing System and Access Thresholds

2. Reserve Asset Requirements

3. Transparency and Information Disclosure

4. Anti - Money Laundering and Counter - Terrorist Financing

5. Law Enforcement Powers of Regulatory Authorities

6. Cross - Border Coordination and Enforcement Powers

7. Investor Protection Mechanisms

8. Technology Progress and Sustainability Supervision

According to the "Stablecoin Bill", any entity intending to engage in the issuance, promotion, or related activities of fiat - backed stablecoins in Hong Kong must meet specific conditions. For example, a license issued by the Hong Kong Monetary Authority, the company's qualifications, the purpose of issuing coins, the review of the target audience and anti - money laundering measures, and continuous supervision after obtaining the license. Among them, potential conflicts and needs for balance, such as the contradiction between innovation and regulation. It should be noted that if the regulatory licensing requirements are too high, it may hinder market innovation.

The reserve asset requirements mainly focus on whether the licensee has "high - quality and highly liquid assets". For example, cash, short - term government bonds, repurchase agreements, and other near - cash assets. These assets have two core characteristics - low volatility and high liquidity, and can be quickly converted into cash during market fluctuations or large - scale redemptions to maintain the fixed exchange rate between the stablecoin and the anchored asset. According to the Stored Value Facility (SVF) license, the licensed institution is required to pay a margin of HK$25 million or 5% of the asset size. For the stablecoin licensing standards, we can also refer to this. For example, if you want to issue HK$10 billion in stablecoins, the reserve assets must be ≥ HK$10 billion in fiat currency. To ensure that the stablecoin can be redeemed at face value at any time and to manage the risk of a run.

The transparency and information disclosure of stablecoins are important aspects of market safety and building market confidence. From the perspective of traditional finance, the confidence of investors in a trading market determines the efficiency and capacity of the market. This is why listed companies in the stock market must be forced to disclose some company revenues (such as the 10K, 10Q, 8K, 13F... required to be disclosed by the SEC), and operation information every quarter and year. So as to make investors more trust the market and ensure the certainty and security of money.

Another obvious problem is raised in the draft. Stablecoins may also be used by criminals as tools for money laundering and terrorist financing due to their anonymity and cross - border liquidity. To this end, a set of targeted rules is formulated to ensure that stablecoin transactions are legal and transparent. Identity verification (KYC), fund tracing, and record - keeping are the three key points of this problem. In the draft, Hong Kong plans to further align with international standards (such as the FATF "Virtual Asset Guidelines"). As long as the transparency of funds and a reasonable range of privacy are guaranteed, this problem can be solved.

In addition, the "Stablecoin Bill" endows the Monetary Authority (Hong Kong Monetary Authority) with strong law enforcement powers to ensure the compliant operation of the stablecoin market. For example, if it is suspected that a stablecoin issuer has embezzled reserve assets, its financial records and transaction data can be directly accessed. If necessary, a third - party institution (such as an accounting firm) can be appointed to assist in the investigation, and even an international expert team can be hired to crack down on cross - border money - laundering chains.

In the context of globalization, the "Stablecoin Bill" in Hong Kong has built a global regulatory network through cross - border coordination mechanisms and strong enforcement powers to ensure the legality and compliance of stablecoin issuance and transactions. For example, if an overseas stablecoin issuer is suspected of money laundering, the Hong Kong Monetary Authority can request the local regulatory authority to assist in the investigation (commonly known as "distant - water fishing"). By obtaining the regulatory power over overseas entities, emergency disposal power, and the cross - border application right of criminal and civil sanctions, it paves the way for the compliant globalization of stablecoins.

In short, after the passage of this draft, a "firewall" for investor protection is built according to six mechanisms: standardized access screening, risk isolation, transparent disclosure, graded sales, rapid compensation, and severe punishment for violations. Its core logic is:

Beforehand: Strictly control the qualifications of issuers to prevent "empty - handed manipulation";

During: Mandate transparent operations to prevent under - the - table dealings;

Afterward: Provide relief channels to reduce the cost of rights protection.

This framework not only lays a compliance foundation for the stablecoin market in Hong Kong but also sets a benchmark for global investor protection - while embracing innovation, it ensures that "retail wallets" are not eroded by financial risky behaviors. A framework for severe violation punishment and enforcement is established. For example, unlicensed issuance or false promotion, or fraudulent behavior, will result in a fine of HK$5 million and imprisonment for 7 years, with a maximum fine of HK$10 million and imprisonment for 10 years.

In the future, Hong Kong may further explore embedding compliance rules into smart contracts, using blockchain technology to achieve automated supervision, and meeting regulatory needs while protecting user privacy. With "controllable risks and orderly innovation" as the core, it not only injects compliance genes into Hong Kong's virtual asset ecosystem but also contributes Oriental wisdom to global financial governance. While holding the bottom line of safety, Hong Kong is welcoming the future of fintech with an open attitude and is committed to becoming a "super contact person" for virtual asset supervision and innovation.

#### (II) U.S. GENIUS Act

On May 19, 2025, the U.S. Senate passed the procedural vote on the "Guiding and Establishing National Innovation for U.S. Stablecoins Act" with 66 votes in favor and 32 votes against. The bill mentions a precise definition of stablecoins, who can issue coins, and the requirements for issuing coins. One of the most concerned points is the capital reserve requirement for stablecoins.

The bill proposes that legally compliant stablecoins in the United States must have 100% reserves corresponding to the number of issued stablecoins, and all reserves must be in cash or equivalent to cash or short - term Bills, CDs in terms of liquidity. And the reserves must be audited and disclosed regularly. And each stablecoin issuer will have 18 months to adjust liquidity to adapt to the new laws and regulations. So far, the stablecoin named USD1 traded on the trading platform is in a fully compliant state.

The GENIUS Act also mentions that algorithmic stablecoins will gradually fade out and some will be禁用 (banned). Due to the death spiral event of Terra/Luna coins in 2022, which exposed the fatal weaknesses and unstable nature of algorithmic stablecoins, stricter legal controls are needed to ensure that similar events do not happen again. The bill also strengthens anti - money laundering (AML), addresses a series of concerns such as handling interests, and prohibits U.S. government officials from issuing stablecoins. It ensures the legal endorsement of Web3.0 and continuous popularization and education in the future. Thus, it reduces a series of criminal behaviors such as fraud, money laundering, and cybersecurity risks.

#### (III) Singapore

On January 14, 2019, Singapore passed the "Payment Services Act 2019" (PSA) and has been continuously revised. As a "forward - looking and flexible framework for regulating Singapore's payment systems and payment service providers", this act replaces the previous "Payment Systems (Supervision) Act" and "Money - Changing and Remittance Businesses Act". In addition, the Monetary Authority of Singapore (MAS) has issued Notice PSN01 (Prevention of Money Laundering and Countering the Financing of Terrorism - Designated Payment Services) in accordance with the PSA, introducing requirements related to anti - money laundering (AML) and countering the financing of terrorism (CFT) for regulated payment service providers. This means that payment service providers must take the following measures to achieve regulatory compliance:

- Risk Assessment and Risk Mitigation

- Customer Due Diligence

- Reliance on Third Parties

- Agent Accounts and Wire Transfers

- Record - Keeping

- Suspicious Transaction Reporting

- Internal Policies, Compliance, Audit, and Training

On March 27, 2025, the Monetary Authority of Singapore issued the "Consultation Paper on the Prudential Treatment of Cryptoasset Exposures and Requirements for Additional Tier 1 and Tier 2 Capital Instruments for Banks" (Consultation Paper on the Prudential Treatment of Cryptoasset Exposures and Requirements for Additional Tier 1 and Tier 2 Capital Instruments for Banks), aiming to implement the updated prudential treatment and disclosure standards for cryptoasset risks by the Basel Committee on Banking Supervision (BCBS). It mentions that cryptoassets that meet all classification conditions are classified as Group 1a cryptoassets (tokenized versions of traditional assets) or Group 1b cryptoassets (cryptoassets intended to be exchanged for a pegged value, where the pegged value is the value of a predefined reference asset or assets and has an effective stabilization mechanism).

For cryptoassets classified as Group 1b cryptoassets, the BCBS specifies a redemption risk test for the prudential treatment of cryptoasset exposures. The goal is to ensure that the reserve assets are sufficient for the cryptoassets to be redeemed at the pegged value at any time. To pass the redemption risk test, banks must ensure that the reserve assets of the cryptoassets meet the conditions related to the value and composition of the reserve assets and the management of the reserve assets.

#### (IV) European Union

In June 2023, the European Union officially issued the "Markets in Crypto - assets Regulation" (MiCA). The regulatory targets of MiCA are divided into two categories:

1) The first category is cryptoasset issuers, including stablecoin issuers and other cryptocurrency issuers.

MiCA has the following main requirements for stablecoin issuers:

- Obtain authorization before issuance

- Fulfill disclosure obligations

- Hold a certain scale of own funds and reserve assets

MiCA has relatively loose requirements for other cryptoasset issuers:

- The issuer must establish a legal entity within the EU

- Publish a white paper

2) The second category of regulatory targets is cryptoasset service providers. The requirements of MiCA for cryptoasset service providers mainly include four aspects:

- Obtain authorization

- Have a sound governance structure

- Meet minimum capital requirements

- Meet consumer protection and transparency requirements

### Potential Issues in RWA Practice Beyond Laws

The passage of the Hong Kong stablecoin draft, the U.S. GENIUS Act, the European MiCA, and the Southeast Asian acts is undoubtedly a major step forward for the application of RWA. However, in addition to laws and regulations, there are some potential issues that cannot be solved by just regulation. For example, the liquidity of RWA on major centralized trading platforms and the anti - fraud and popular science education of RWA Web3.0. These issues are not weaknesses of RWA but more of uncertainties and things that only time can promote.

When people focus on improving the legal framework, RWA still faces multiple hidden challenges at the practical level, and its development path may be more like a "marathon" rather than a "sprint".

#### (I) Liquidity Dilemma: The "False Proposition" of Centralized Platforms

Currently, the liquidity of RWA on centralized trading platforms (CEX) and the assets bound to them on traditional financial exchanges shows obvious polarization. Take Hong Kong as an example. Although the issuance of compliance licenses has accelerated the entry of institutional funds, the daily liquidity of some funds, such as the U.S. Treasury token of BlackRock's BUIDL, is obviously insufficient. This gap between theory and practice stems from the heterogeneity of RWA assets themselves: securitized tokens require a relatively new and complex custody and clearing system. More importantly, the liquidity premium mechanism of the traditional financial market has not been fully migrated to the chain. The on - chain token of the same commercial real estate may be repeatedly mortgaged on multiple platforms, and the delayed synchronization between the off - chain registration system and the public chain data makes it difficult for arbitrageurs to close the price gap.

#### (II) Education Gap: The Cognitive Mismatch between Web3 Natives and the Real World

The complexity of anti - fraud education far exceeds simple risk warnings. Web3 users in many regions where it has been legalized, such as some investors in Singapore, misunderstand "RWA" as a new type of stablecoin, while European pension fund investors compare RWA tokenized bonds with the yields of traditional ABS products. This cognitive bias gives rise to new forms of fraud. For example, a project packages its bonds into "RWA tokens endorsed by the central bank" by forging a government digital signature and illegally raises funds on a decentralized forum. The information disclosure templates required by regulatory agencies are difficult to cover such targeted frauds that take advantage of differences in technical cognition.

#### (III) Technical Debt: The Underestimated Cost of Off - Chain and On - Chain Collaboration

Existing RWA solutions generally fall into the "oracle paradox". For example, when a certain trust synchronizes rental income through the Chainlink oracle, the node operator requires it to provide dual offline and online audit reports. This hybrid architecture leads to increasing marginal costs. A European railway asset tokenization project was forced to postpone an asset migration plan worth 800 million euros due to security disputes of the Polkadot and Cosmos cross - chain bridges. These are undoubtedly more wear and risks than those in the traditional financial system. Given that the architecture is so complex and there are more problems at this stage than in the traditional architecture, what solutions or incentives can make people more willing to use the RWA token system?

To solve these deep - seated contradictions, it is necessary to go beyond the mere technical or regulatory dimensions: At the liquidity level, a "custody + oracle" dual - track system can be discussed, allowing traditional custody institutions to issue digital ownership certificates on the chain, such as Ondo Finance and its series of product solutions. In terms of popularization and education, the RWA sandbox simulator launched by Hong Kong Cyberport has begun to use a gamified interface to display the full - process risk nodes of asset tokenization. The real maturity of RWA may give birth to a "third - type infrastructure" between traditional finance and crypto - ism. When the market enthusiastically discusses the milestone of RWA's market value exceeding $50 billion, it may be more appropriate to pay attention to those hidden costs not included in the financial reports. These undercurrent details remind us that the evolution speed of RWA ultimately depends on the integration efficiency of the real world and the digital native ecosystem, and this is destined to be a long - cycle game that requires patience and wisdom.

**Disclaimer**: The views in this article only represent the personal views of the author and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness, originality, and timeliness of the article information, nor does it assume responsibility for any losses caused by the use or trust of the article information.

Contact: Sarah

Phone: +1 6269975768

Tel: +1 6269975768

Email: xttrader777@gmail.com

Add: 250 Consumers Rd, Toronto, ON M2J 4V6, Canada