X-trader NEWS

Open your markets potential

Opinion: Wall Street is counting on Bitcoin’s high volatility for year-end bonuses

# Written by Jeff Park, Advisor at Bitwise

# Compiled by Moni, Odaily Planet Daily

In just six weeks, Bitcoin’s market capitalization has evaporated by $500 billion. Amid ETF outflows, Coinbase trading at a discount, structural sell-offs, and liquidations of poorly positioned long positions, there has been no obvious catalyst to fuel a market rebound. Moreover, lingering concerns—such as whale sell-offs, severely loss-making market makers, a lack of defensive liquidity supply, and existential threats posed by the "quantum crisis"—continue to hinder Bitcoin’s potential for a rapid recovery. Yet throughout this downturn, one question has persisted in the community: What exactly has happened to Bitcoin’s volatility?

In fact, Bitcoin’s volatility mechanism has quietly shifted.

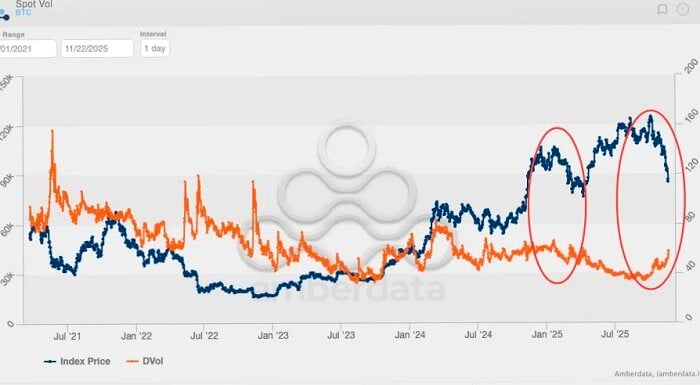

Over the past two years, there has been a widespread belief that ETFs have "tamed" Bitcoin, suppressed its volatility, and transformed this once macroeconomically sensitive asset into a regulated, volatility-constrained trading instrument overseen by institutions. However, a closer look at the past 60 days reveals a different reality: the market seems to have returned to its former volatile state.

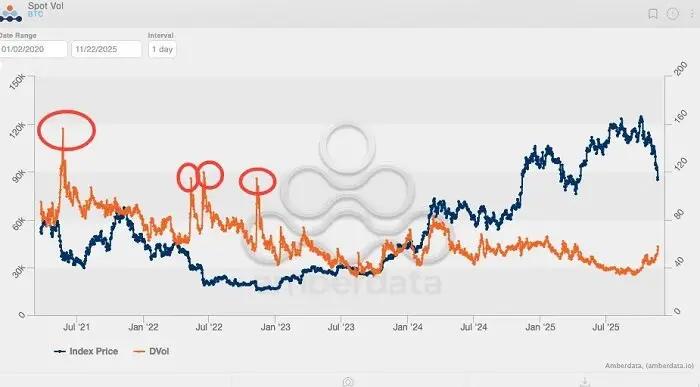

A review of Bitcoin’s implied volatility over the past five years shows a clear pattern in its peak levels:

- The first (and highest) peak occurred in May 2021, when a crackdown on Bitcoin mining sent implied volatility surging to 156%.

- The second peak emerged in May 2022, triggered by the Luna/UST collapse, reaching 114%.

- The third peak spanned June to July 2022, amid the liquidation of Three Arrows Capital (3AC).

- The fourth peak took place in November 2022, following the FTX meltdown.

Since then, Bitcoin’s volatility has never exceeded 80%. The closest it came was in March 2024, during a three-month stretch of sustained inflows into spot Bitcoin ETFs.

An even clearer pattern emerges when examining Bitcoin’s "vol-of-vol index"—essentially the second derivative of volatility, or a measure of how quickly volatility itself changes. Historical data shows that the index’s highest reading occurred during the FTX collapse, when it soared to approximately 230. However, since the regulatory approval and launch of ETFs in early 2024, Bitcoin’s vol-of-vol index has never exceeded 100, and implied volatility has continued to decline, regardless of spot price movements. In other words, Bitcoin seemed to have lost the hallmark high-volatility behavior that defined its market structure before ETFs.

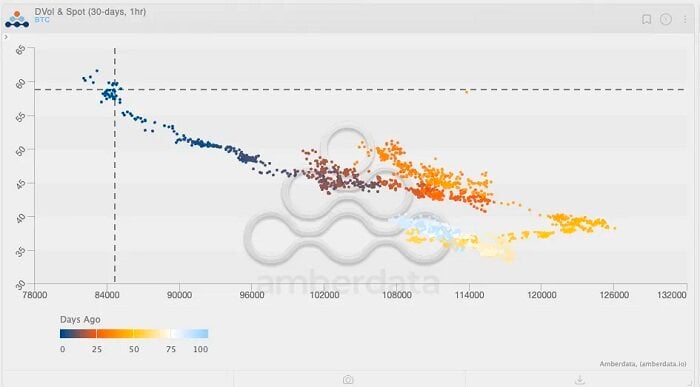

Over the past 60 days, however, things have changed: Bitcoin’s volatility has risen for the first time since 2025.

Refer to the chart above and note the color gradient (light blue to dark blue representing "days ago"). Tracking recent trends, you’ll notice a brief window where the spot Bitcoin vol-of-vol index climbed to around 125, while implied volatility also rose. At the time, these volatility indicators seemed to suggest a potential market breakout—after all, volatility and spot prices had previously shown a positive correlation. Yet, as we now know, the market did not rally as expected; instead, it reversed course and declined.

More notably, implied volatility (IV) continued to rise even as spot prices fell. Since the ETF era began, it has been rare for Bitcoin’s price to decline steadily while implied volatility climbs. This phase could well mark another critical "inflection point" in Bitcoin’s volatility dynamics: implied volatility is returning to the state it was in before ETFs existed.

To better understand this trend, we can analyze it using a skew chart. During sharp market downturns, put option skew typically surges rapidly—and indeed, during the three major events mentioned earlier, skew reached -25%.

PREVIOUS:ProCap CIO: Bitcoin put options OI scale was

NEXT:A giant whale bought 4022 ETH spot and went l

Contact: Sarah

Phone: +1 6269975768

Tel: +1 6269975768

Email: xttrader777@gmail.com

Add: 250 Consumers Rd, Toronto, ON M2J 4V6, Canada