X-trader NEWS

Open your markets potential

OKX, Tether and other crypto leaders are gathering to return to the U.S. market, and four major paths point the way

# Author: Wenser

As 2025 draws to a close, the crypto-friendly regulatory environment fostered by the U.S. government has become increasingly solid. Seizing this opportunity, many crypto projects are sparing no effort to compete for a share of this crucial market. Specifically, their strategies can be roughly categorized into four paths: the "circuitous approach" represented by Polymarket, the "point-to-area expansion approach" represented by Binance, the "crypto IPO approach" represented by OKX, and the "build-from-scratch approach" represented by Tether.

In this article, Odaily Planet Daily will briefly introduce the above four paths for re-entering the U.S. market, providing reference for crypto projects and trading platforms.

## Polymarket’s "Circuitous Path" to the U.S. Market: Settling with the U.S. CFTC and Acquiring Derivatives Exchange QCX

As one of the most popular crypto projects and a leading prediction market today, Polymarket has a long-standing connection with the U.S. market.

In 2020, leveraging the high-profile U.S. presidential election, Polymarket’s trading volume exceeded $3 million within just three weeks of its launch.

However, the good times did not last long. After roughly a year, Polymarket caught the attention of the U.S. Commodity Futures Trading Commission (CFTC).

In October 2021, the U.S. CFTC launched an investigation into Polymarket, focusing on issues such as "whether the platform allowed customers to improperly trade swaps or binary options, and whether it should be registered with the agency." At that time, Polymarket hired James McDonald—former head of the CFTC’s Enforcement Division and a partner at the law firm Sullivan & Cromwell—to assist in addressing the investigation.

In January 2022, three weeks after being fined $1.4 million by the U.S. CFTC and ordered to shut down its market, Polymarket finally relaunched. However, the official statement clarified that U.S. residents would not be able to trade on the platform.

Since then, Polymarket closed its doors to what is perhaps the world’s wealthiest crypto user base. Many U.S. users have been eagerly awaiting the chance to trade on the prediction market—and this wait lasted three years.

After successfully predicting Trump’s victory in last year’s U.S. presidential election, Polymarket was accused by the U.S. Department of Justice (DOJ) in November of that year, with an investigation launched into its "allowance of U.S. users to trade." The Federal Bureau of Investigation (FBI) even issued a search warrant for Polymarket CEO Shayne Coplan and seized his mobile phone and electronic devices.

Ultimately, however, with Trump taking office, the U.S. crypto regulatory landscape underwent a major cleanup—and Polymarket finally ushered in its "regulatory spring."

In July this year, the U.S. DOJ officially closed its investigation into Polymarket, and the U.S. CFTC simultaneously terminated its probe. Shortly afterward, Polymarket acquired QCX, a U.S. compliant derivatives exchange, for $112 million. Notably, QCX obtained CFTC approval to operate on July 9—a timing so coincidental that it inevitably sparks speculation.

In September this year, after the U.S. CFTC terminated its investigation, Polymarket finally received a "no-action letter" jointly issued by the CFTC’s Division of Market Oversight and Division of Clearing and Risk, allowing it to re-enter the U.S. market under specific conditions.

In October, sources reported that Polymarket would reopen to U.S. users by the end of November. Additionally, insiders indicated that Polymarket’s token issuance and airdrop would be implemented after its re-entry into the U.S. market, possibly in 2026.

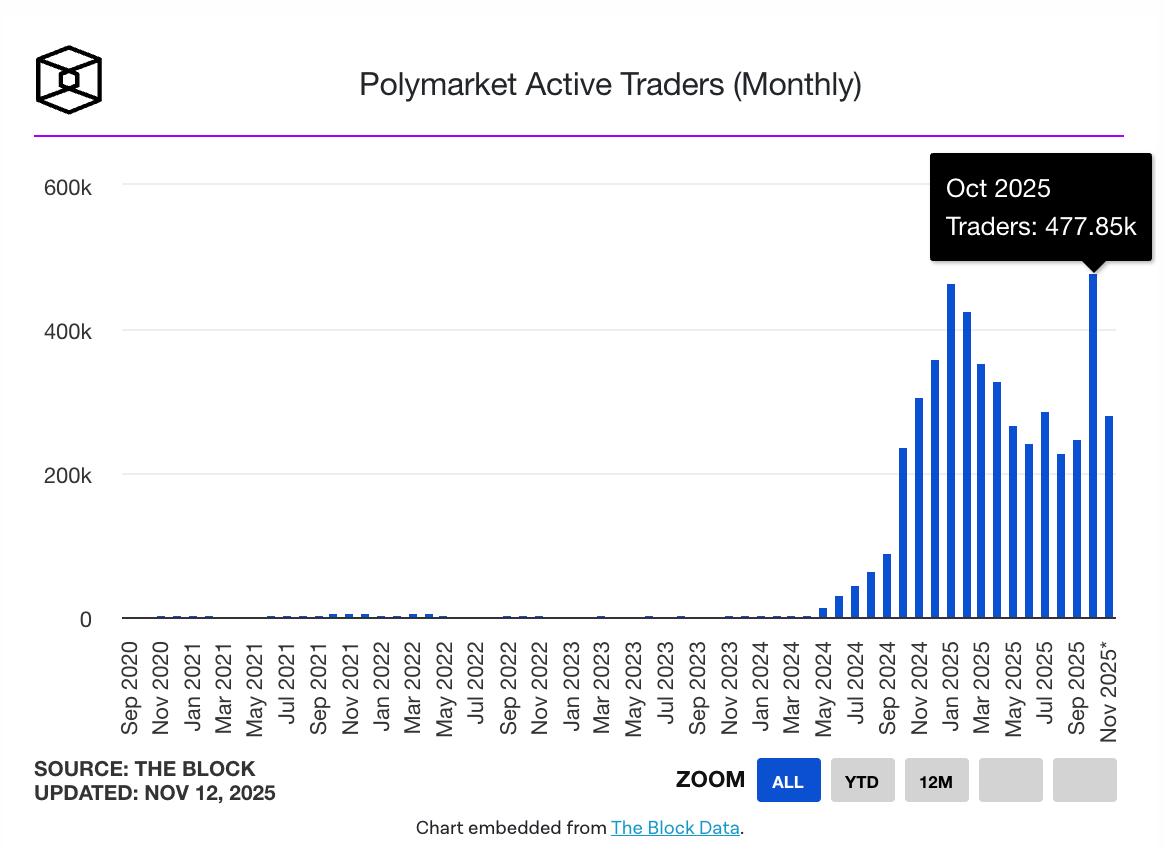

According to data from TheBlock, Polymarket’s monthly active users hit a record high last month, reaching 477,000.

# Binance’s "Point-to-Area Expansion" Path: CZ Granted Presidential Pardon by Trump, Binance Poised to Integrate Binance.US for U.S. Market Return

Compared with Polymarket, there are no confirmed timelines or precise details regarding Binance’s return to the U.S. market. However, the recent presidential pardon of CZ (Changpeng Zhao) by Trump has brought a new turning point for this endeavor, and the existence of Binance.US provides a foundation for Binance to integrate its business and re-enter the U.S. market.

In November 2023, due to failures in effectively implementing anti-money laundering (AML) procedures and allegations of violating the U.S. *Bank Secrecy Act (BSA)*, CZ, the founder of Binance, resigned as CEO and agreed to pay a $4.3 billion settlement fine. The matter ultimately concluded with "Binance withdrawing from the U.S. market and CZ being sentenced to 4 months in prison on April 30, 2024."

In December 2024, when asked about "whether Binance would seek ways to re-enter the U.S. market," Binance CEO Richard Teng stated: "I think it’s too early to discuss whether we will re-enter the U.S. market. As of now, we are focusing on our global deployment and paying attention to institutions, sovereign wealth funds, and high-net-worth individuals that will begin allocating funds to the crypto sector."

Less than a year later, the situation changed dramatically after CZ was granted a presidential pardon by Trump.

In October this year, according to *The Wall Street Journal*, Trump exercised his presidential pardon power to pardon CZ. CZ subsequently stated publicly that he was deeply grateful for the pardon and for President Trump’s commitment to upholding fairness, innovation, and justice in the United States. He pledged to do everything possible to help the U.S. become a cryptocurrency hub and promote the global development of Web3.

Furthermore, Trump stated publicly that he pardoned Binance founder Changpeng Zhao because CZ was "innocent" and had been "persecuted by the Biden administration." Although the move was later condemned by Democratic U.S. Senators such as Elizabeth Warren and Adam Schiff (who described it as "bare corruption" and called on Congress to take measures to prevent similar incidents from recurring), Trump’s pardon is still widely viewed as paving the way for Binance’s return to the U.S. market.

In March this year, Binance executives met with U.S. Treasury officials to discuss easing the U.S. government’s regulatory restrictions on the company. In April, sources reported that Binance was exploring the possibility of reaching a commercial cooperation agreement with the Trump family’s cryptocurrency project. Some insiders revealed that Binance executives had proposed to Treasury officials in Washington the removal of the independent monitor position responsible for overseeing the company’s AML compliance— a move seen as the first step toward Binance’s U.S. market return.

Notably, Binance previously received a $2 billion investment from the UAE sovereign fund MGX, and the funds were denominated in USD1, a U.S. dollar stablecoin issued by WLFI (the Trump family’s crypto project). This information was later confirmed by Eric Trump, the second son of Donald Trump.

Based on existing information, whether CZ can return to a core position at Binance in the future may determine the pace of Binance’s U.S. market re-entry. Additionally, Binance has officially returned to the South Korean market through its acquisition of the South Korean crypto exchange Gopax.

# OKX’s "Crypto IPO" Path: Reaching a Settlement with the U.S. DOJ, Returning to the U.S. Market in April, and Planning a U.S. IPO

Compared with Polymarket and Binance, OKX has adopted a more "steady and incremental" approach to re-entering the U.S. market. On one hand, by settling with the U.S. Department of Justice (DOJ) and paying fines, OKX has already completed its return to the U.S. market. On the other hand, according to media reports, OKX is not content with merely returning to the U.S.—it is also actively preparing for an initial public offering (IPO).

In February this year, OKX officially announced that its Seychelles subsidiary had reached a settlement with the U.S. DOJ regarding an investigation. The company acknowledged that due to historical deficiencies in compliance controls, a small number of U.S. customers had previously traded on its global platform. Under the settlement agreement, OKX agreed to pay an $84 million fine and forfeit approximately $421 million in revenue earned from U.S. customers during this period (most of which came from a small number of institutional clients). Notably, the settlement included no allegations of customer harm, no charges against any company employees, and no appointment of a government monitor.

Furthermore, OKX stated that it would enhance its Know Your Customer (KYC) system and Customer Risk Rating (CRR) system, expand its Enhanced Due Diligence (EDD) program, and deploy industry-leading anti-money laundering (AML) and sanctions compliance tools. To this end, the company has already established a professional investigation team with over 150 members.

In April, OKX announced its official entry into the U.S. market and plans to establish a regional headquarters in California. The company stated that it would launch a centralized trading platform and the OKX Wallet for U.S. users. Existing OKCoin users will be migrated to the OKX platform, and new user onboarding will be carried out in phases, with a full U.S.-wide rollout expected later this year. OKX emphasized that it will actively cooperate with U.S. regulators, operate in compliance with current laws and regulations, and has established a compliance system covering mechanisms such as KYC, AML, risk assessment, and transaction monitoring.

In June, Yueqi Yang, a crypto reporter at *The Information*, revealed that OKX is considering an IPO in the United States, following its return to the U.S. market in April.

Of course, despite this news, the regulatory hurdles for a crypto IPO are likely significant, and no further accurate details have emerged in the market so far. Odaily Planet Daily will continue to track developments.

# Tether’s "Build-from-Scratch" Path: Issuing the USAT USD Stablecoin and Appointing a Former White House Official as CEO

Compared with the previous three projects and platforms, Tether—known as the "stablecoin hegemon"—has chosen a more arduous "build-from-scratch" path: issuing a new USD-backed stablecoin called USAT, while making thorough "compliance preparations" in terms of partners and CEO selection.

In September this year, according to official announcements, Tether announced plans to launch USAT, a USD-backed stablecoin to be issued under the U.S. regulatory framework. Additionally, the company appointed Bo Hines, former Executive Director of the White House Crypto Council, as the CEO of Tether USAT.

It is understood that Tether officially stated that USAT will strictly comply with the regulatory standards of the U.S. *GENIUS Act*, be supported by transparent reserves, and aim to provide enterprises and institutions with a digital alternative to cash and traditional payment systems. This stablecoin will leverage Tether’s Hadron technology platform, with Anchorage Digital—a federally regulated crypto bank—serving as the compliant issuer, and Cantor Fitzgerald acting as the designated reserve custodian.

Paolo Ardoino, CEO of Tether, stated that the launch of USAT is a natural step to ensure the U.S. dollar maintains its dominant position in the digital age. Subsequently, Bo Hines, CEO of USAT, also noted that Tether’s goal in returning to the U.S. market is to replicate the success it has achieved overseas.

In October, Bloomberg quoted sources as saying that Tether plans to launch its new stablecoin USAT on the video platform Rumble. Rumble previously received an investment of up to $775 million from Tether and boasts 51 million monthly active users in the U.S.; this move is aimed at capturing the U.S. market.

In the latest development, according to Coindesk reports, Tether plans to launch USAT—its stablecoin targeting the U.S. market—in December, in compliance with federal regulatory requirements outlined in the GENIUS Act. The token will be issued by Tether America, a joint venture between Tether and Anchorage Digital, a regulated U.S. crypto bank. Paolo Ardoino, CEO of Tether, stated that the company is expanding USAT’s user base through investments, with the goal of reaching 100 million U.S. users.

# Conclusion: The U.S. Market Is One of the Few "Crypto Growth Drivers" and a Battleground for Competitors

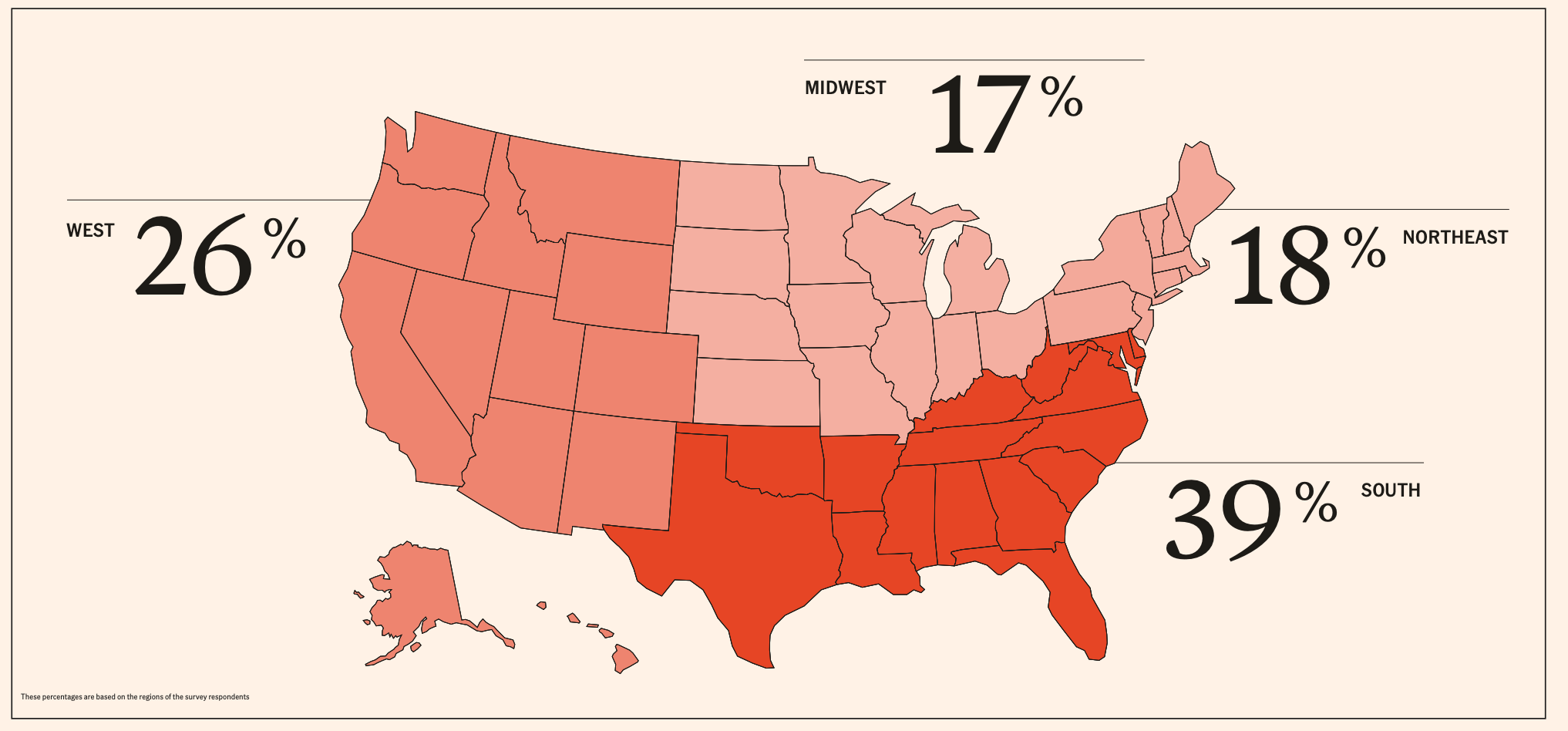

According to the *2025 Cryptocurrency Holder Survey Report* released by the U.S. National Cryptocurrency Association in April this year, approximately 21% of U.S. adults—equivalent to 55 million people—own some form of cryptocurrency. This means one out of every five Americans holds cryptocurrency. Additionally, 39% of holders use cryptocurrency to pay for goods and services, and 76% of respondents stated that cryptocurrency has had a positive impact on their lives. From the perspective of the geographical distribution of crypto users, the penetration rate of cryptocurrency in the southern and western regions of the U.S. is even close to 30% to 40%.

In a market environment with increasingly tight liquidity, this undoubtedly represents a larger pool of crypto users, more crypto capital, and potential business profits. It comes as no surprise, then, that many crypto giants are still diligently pursuing a return to the U.S. market. The reason is simple: it all boils down to "profit."

After crypto giants such as Circle, Gemini, and Bullish have all made their pushes for IPOs, the next players waiting for a new round of capital infusion are naturally exchanges like Kraken and OKX. As for their market performance, it is believed that users and capital will vote with their actions.

Furthermore, Coinlist, a digital asset sales platform, also announced its return to the U.S. market in April this year. Recently, Coinbase opened up Monad token sales to U.S. users—this marks a milestone event, as it is the first time U.S. users have been able to participate in token sales in 7 years, since 2018. For the crypto market, a new wave of "U.S. retail investors" may well be on the way.

# Disclaimer

The views expressed in this article are solely those of the author and do not constitute investment advice from this platform. This platform makes no guarantees regarding the accuracy, completeness, originality, or timeliness of the information in the article, nor does it assume any liability for any losses arising from the use of or reliance on the information contained herein.

Contact: Sarah

Phone: +1 6269975768

Tel: +1 6269975768

Email: xttrader777@gmail.com

Add: 250 Consumers Rd, Toronto, ON M2J 4V6, Canada