X-trader NEWS

Open your markets potential

Well-known short-seller closes MSTR/BTC position, is crypto treasury turning a corner?

Famous short-seller James Chanos has officially closed out his 11-month-old hedging position between Strategy Inc. ($MSTR) and Bitcoin. This marks the end of his high-profile short-selling campaign targeting Bitcoin-related stocks and Strategy—the benchmark stock in this sector.

The closing of institutional short positions is a signal of a potential trend reversal, which may indicate that the darkest hour for Bitcoin reserve companies is now in the past.

In recent weeks, the ecosystem of Bitcoin reserve companies has suffered a heavy blow.

Most relevant enterprises have seen their stock prices plummet sharply from the highs reached earlier this year. Analysts previously advised investors to short stocks like Strategy and solemnly warned that a bubble had emerged in the Bitcoin reserve company sector, which could burst at any time without warning.

However, just as short-selling pressure peaked, a turning point may be on the horizon. Last Saturday, Pierre Rochard—CEO of The Bitcoin Bond Company and a veteran expert in the cryptocurrency reserve field—claimed that the bear market for Bitcoin reserve companies is "gradually coming to an end."

In his view, the closing of institutional short positions is one of the clearest signals in the industry, implying a potential shift in market sentiment: "The market is still expected to remain volatile, but this kind of signal is exactly the key sign needed for a trend reversal."

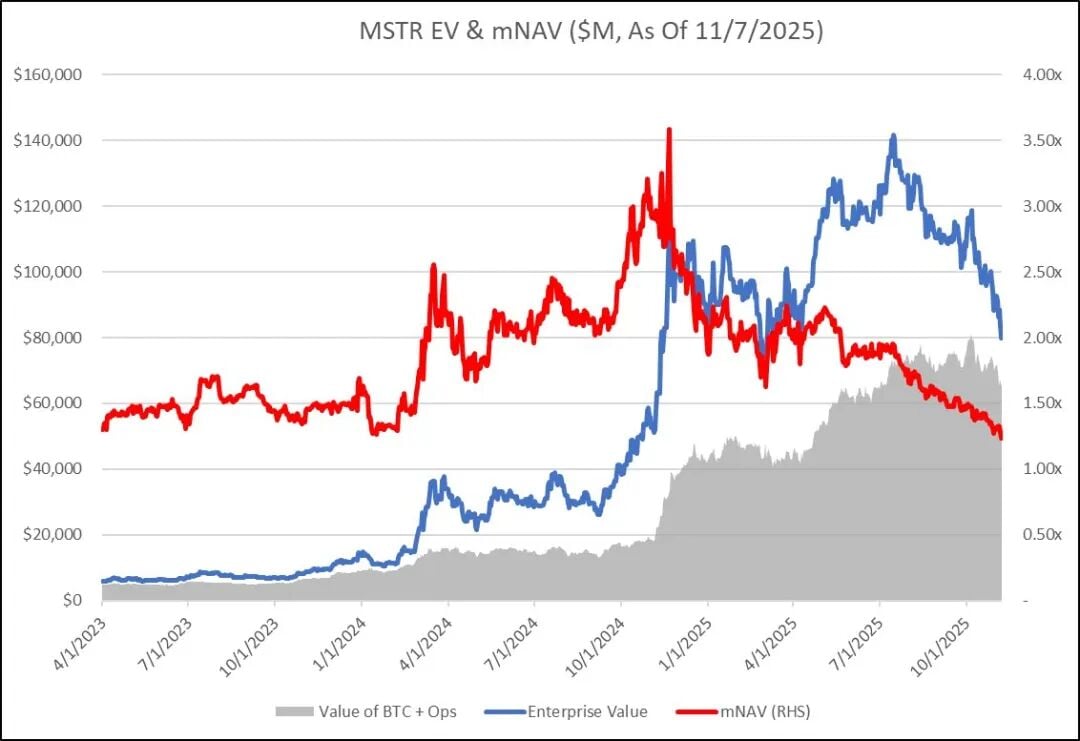

While this is far from a reason for celebration, it is a precious glimmer of hope—like rain after a long drought—for investors who have long struggled with negative sentiment and are still plagued by issues related to modified Net Asset Value (mNAV).

And James Chanos is a central figure among these short sellers. The well-known investor has always held a hostile stance toward all assets tied to Bitcoin.

His decision to close the 11-month-old hedging position between Strategy and Bitcoin also marks the official end of his high-profile short-selling against this "benchmark enterprise for corporate Bitcoin hoarding."

Notably, MicroStrategy Inc. currently holds over 640,000 Bitcoins and continues to increase its holdings on dips. Such an approach makes it seem as if its founder, Michael Saylor, has never heard of the concept of "risk management."

Chanos confirmed the move on the X platform, which immediately sparked a heated debate in the cryptocurrency Twitter community—with numerous posts discussing "whether the market has hit bottom" quickly flooding the feed.

He posted: "Given the many inquiries I’ve received, I confirm that I closed out the hedging position between MicroStrategy and Bitcoin at the opening of trading yesterday."

At the same time, institutional attitudes toward cryptocurrencies are quietly changing. Traditional financial giants have entered the space one after another; they are no longer naysayers but have become industry stakeholders, market participants, and more importantly, innovators in cryptocurrency reserves.

JPMorgan Chase’s recent布局 in business related to BlackRock’s spot Bitcoin Exchange-Traded Fund (ETF), along with a series of recently revealed custody and clearing cooperation agreements, all indicate that corporate acceptance of Bitcoin is no longer a "wild and unregulated exploration" but is gradually becoming a strategic decision at the corporate board level.

Whether it is driving capital inflows into exchange-traded products, adjusting reserve yield strategies, or rating digital assets on par with real-world securities, this transformation is advancing quietly.

Of course, this does not mean that Bitcoin reserve companies will soon be rid of volatility. Uncertainties in the macroeconomic environment and fluctuations in regulatory policies remain the Sword of Damocles hanging over Bitcoin.

However, the significance of well-known skeptics like Chanos closing out major short positions goes far beyond simple capital flows—it is an important turning point in market psychology.

Whether for Bitcoin prices or institutional narratives, the signal is clear: the darkest hour may have passed, and the writers of the industry’s next chapter will no longer be the familiar faces of the past.

## Disclaimer

The views in this article represent the author’s personal opinions only and do not constitute investment advice for this platform. This platform makes no guarantees regarding the accuracy, completeness, originality, or timeliness of the information in the article, nor does it assume any liability for losses arising from the use or reliance on the information in the article.

Contact: Sarah

Phone: +1 6269975768

Tel: +1 6269975768

Email: xttrader777@gmail.com

Add: 250 Consumers Rd, Toronto, ON M2J 4V6, Canada