X-trader NEWS

Open your markets potential

Traditional finance embraces innovation: French century-old bank ODDO BHF launches the euro stable currency EUROD under the MiCA framework

# ODDO BHF Launches Euro-Backed Stablecoin EUROD Under EU's MiCA Framework

French banking group ODDO BHF has launched EUROD, a euro-backed stablecoin. This token is a MiCA-compliant digital version of the euro, operating under the European Union’s new *Markets in Crypto-Assets Regulation* (MiCA) framework.

The move by this 175-year-old bank highlights how traditional financial institutions are gradually expanding into the regulated blockchain finance sector.

ODDO BHF, which manages over €150 billion in assets, stated that EUROD will be listed on Bit2Me, a Madrid-based exchange.

Supported by Telefónica, BBVA (Banco Bilbao Vizcaya Argentaria), and Unicaja Banco, Bit2Me is registered with Spain’s National Securities Market Commission (CNMV) and is among the first exchanges to obtain MiCA authorization—a license that allows it to expand its operations across the EU.

ODDO BHF has partnered with infrastructure provider Fireblocks to handle custody and settlement services. EUROD is issued on the Polygon network to enable faster and lower-cost transactions. The token is fully backed by euro reserves and subject to external audits.

Leif Ferreira, CEO of Bit2Me, commented that against the backdrop of Europe embracing regulated digital assets, this listing "builds a bridge between traditional banks and blockchain infrastructure."

The *Markets in Crypto-Assets Regulation* (MiCA), which took effect this year, requires stablecoin issuers to maintain a 1:1 reserve ratio, ensure redeemability, and enforce strict governance and transparency standards.

The launch of EUROD will test the practical effectiveness of MiCA in harmonizing digital asset regulation across the EU.

Christine Lagarde, President of the European Central Bank (ECB), recently warned that foreign stablecoins lacking "sound and equivalent regulatory mechanisms" could trigger reserve runs in the eurozone.

In a letter to the European Parliament, she urged lawmakers to restrict stablecoin issuance rights to EU-authorized entities, citing the collapse of TerraUSD as evidence of the risks posed by unregulated projects.

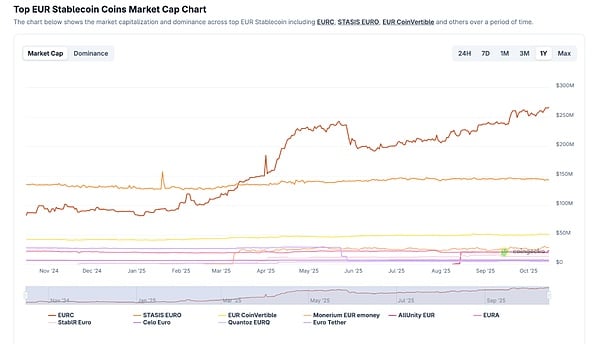

According to CoinGecko data, the market capitalization of euro-pegged stablecoins has doubled this year. EURC, issued by Circle, dominates the market, with its market cap rising to approximately $270 million.

However, under the MiCA framework, demand for bank-issued stablecoins—such as EUR CoinVertible by Société Générale—remains relatively low.

Jürgen Schaaf, an advisor to the ECB, argued that Europe must accelerate its pace of innovation; otherwise, it may face the risk of "erosion of monetary sovereignty."

The European Systemic Risk Board (ESRB) has warned that the multi-issuer model, where EU and non-EU entities jointly issue the same stablecoin, could introduce systemic risks and require enhanced regulation.

Despite these warnings, the regulatory clarity brought by MiCA has spurred market competition:

- Société Générale’s FORGE division has launched the euro stablecoin EURCV.

- Deutsche Börse has partnered with Circle to integrate EURC and USDC into its trading systems.

- A Dutch consortium of 9 European banks—including ING, Spain’s CaixaBank, and Denmark’s Danske Bank—plans to issue a MiCA-compliant euro stablecoin in 2026. Citigroup later joined the consortium, with the stablecoin expected to launch in the second half of 2026.

Meanwhile, 10 G7 banks—including Citigroup and Deutsche Bank—are exploring the issuance of multi-currency stablecoins to modernize settlement processes and enhance global liquidity.

Compared to dollar-pegged stablecoins, which exceed $160 billion in market capitalization, the total market cap of euro-backed stablecoins remains small, at less than $574 million.

Regulators believe that if managed transparently, euro-denominated digital assets will help strengthen financial sovereignty.

For ODDO BHF, EUROD represents a strategic initiative to attract institutional clients through compliance and credibility.

The growth of this stablecoin will depend on adoption by payment providers and investors, who are seeking reliable euro alternatives in the digital economy.

## Disclaimer

The views expressed in this article are solely those of the author and do not constitute investment advice on this platform. This platform makes no guarantees regarding the accuracy, completeness, originality, or timeliness of the information contained in the article, nor shall it be liable for any losses arising from the use of or reliance on such information.

Contact: Sarah

Phone: +1 6269975768

Tel: +1 6269975768

Email: xttrader777@gmail.com

Add: 250 Consumers Rd, Toronto, ON M2J 4V6, Canada