X-trader NEWS

Open your markets potential

Gold prices surged again, and a review of the five major gold tokens in one article

# Gold Prices Surge to New Highs; World Gold Council Plans to Launch "Digital Gold"

Recently, gold prices have continued to surge. Spot gold broke through $3,547 per ounce to hit a record high, and analysts predict it may reach the range of $3,600-$3,900 in the future. The World Gold Council (WGC) plans to launch "digital gold," aiming to improve the efficiency of gold trading and collateralization through digital means, which may reshape London’s $900 billion physical gold market. Currently, the total market value of the gold tokenization market is approximately $2.6 billion, accounting for only 1% of the gold ETF market, indicating significant growth potential. Major gold tokens include:

- **XAUT (issued by Tether)**: With a market value of $1.32 billion, backed by over 7.66 tons of physical gold;

- **PAXG (issued by Paxos)**: With a market value of approximately $1 billion, seeing continuous capital inflows in the past three months;

- **KAU (issued by Kinesis)**: With a market value of approximately $160 million, supporting consumption and profit distribution;

- **XAUm (issued by Matrixport)**: With a market value of approximately $47 million, supporting multi-asset investment and collateralized lending;

- **VRO (issued by VeraOne)**: With a market value of approximately $41 million and relatively limited liquidity.

The rise in gold prices is driven by geopolitical risks, interest rate cut expectations, and the U.S. dollar debt situation. Gold tokens, which combine safe-haven and tax-avoidance attributes, may become an important investment option.

By: Wenser, Odaily Planet Daily

On September 2, spot gold rose by more than 1% intraday, breaking through $3,510 per ounce to a high of $3,512.27 per ounce, setting a new all-time high. On the morning of September 3, spot gold surged by over $10 in a short period, reaching a peak of $3,547 per ounce, hitting a new high again. Surprisingly, sources indicate that the World Gold Council is seeking to launch "digital gold," which may transform London’s $900 billion physical gold market. Odaily Planet Daily will summarize recent gold price trends, industry developments, and major gold tokenization projects in this article for readers’ reference.

## Gold Reaches New Highs; Analysts Predict Prices May Rise to $3,900 per Ounce

On September 1, spot gold stood at $3,470 per ounce, continuing to hit a new high since April 22 this year, with an intraday increase of 0.67%.

Subsequently, within just 2 days, gold prices quickly broke above $3,500 per ounce and gradually stabilized. As a result, the industry has shifted to a highly bullish stance on the future trend of gold prices.

### Analysts: Gold Prices Expected to Reach $3,600-$3,900 per Ounce in the Next Few Months

Priyanka Sachdeva, an analyst at Philip Nova, stated in a report that if spot gold prices continue to break through $3,500, gold may reach the range of $3,600-$3,900 per ounce in the next few months. She noted that the U.S.’s aggressive tariff stance has increased geopolitical risks, boosting safe-haven investments. Driven by factors such as interest rate cut expectations, political unrest, and strong ETF demand, gold has transformed from a tactical hedge to a strategic must-have asset for many investors, she said. Sachdeva believes that the target of $3,800 per ounce may be the first clear psychological threshold for gold prices to break through current highs.

## Financial Times: World Gold Council Plans to Launch "Digital Gold"

According to a report by the *Financial Times*, the World Gold Council (WGC) is seeking to launch a digital form of gold. This move may create a new way to trade, settle, and use gold as collateral, thereby revolutionizing London’s $900 billion physical gold market.

David Tait, CEO of the World Gold Council, said in an interview that this new form will make it possible for "gold to be transferred digitally as collateral within the gold ecosystem for the first time." Although many investors value gold precisely for its physical nature and lack of counterparty risk, viewing it as a safe-haven asset, Tait believes that gold must be digitized to expand its market reach. "We are trying to establish a standardized digital layer for gold, so that various financial products used in other markets can be applied to the gold market in the future. My goal is to make many asset managers around the world re-examine gold," Tait stated.

This move is seen as a response by the World Gold Council to the new financial investment environment. Although gold has long been regarded as a safe-haven asset due to its physical properties and no counterparty risk, in the eyes of many banks and investors, gold is an asset with poor liquidity and no returns. As Tait put it: "For banks, from the perspective of collateral alone, they can earn huge profits—because they have the opportunity to use the gold on their balance sheets as collateral."

It is understood that this plan is mainly promoted by a new digital unit called "Pooled Gold Interests (PGIs)", which will allow banks and investors to buy and sell partial ownership of physical gold stored in independent accounts. In the first quarter of 2026, commercial institutions in London will participate in a pilot of this model.

Currently, trading in the London gold market is divided into "allocated gold" transactions (involving specific gold bars) and "unallocated gold" transactions (only agreeing on the quantity of gold without specifying specific bars). The emergence of "digital gold" may add a third type to London’s over-the-counter (OTC) gold trading.

## Market Status: Market Value of Gold Tokenization Projects Is Less Than 1% of That of Gold ETFs

According to Coingecko data, the total market value of the tokenized gold market is currently around $2.6 billion. Compared with the gold ETF market, which has a market value of $400 billion, the former accounts for less than 1% of the latter. In contrast, the gold tokenization market is still in its early stages and has huge growth potential. The following is an introduction to specific gold tokenization projects:

### XAUT: Backed by Tether, Market Value of $1.32 Billion

According to on-chain data, Tether minted 129,000 XAUT tokens on Ethereum in early August, currently worth approximately $455 million. As a result, its market value now stands at $1.32 billion.

Previously, Paolo Ardoino, CEO of Tether, revealed in a post that if Tether were regarded as a "country," its physical gold holdings would rank among the top 40 globally. In July, Tether released an audit report on XAUT, stating that the circulation of XAUT tokens at that time was 246,524,330 (now increased to approximately 375,572), and the circulating XAUT tokens were backed by more than 7.66 tons of physical gold.

### PAXG: Backed by Paxos, Market Value of Approximately $1 Billion

PAXG is launched by Paxos, a U.S.-based stablecoin company. Its market value has soared to a record high of over $1 billion in the past three months. Since June, the token has seen continuous capital inflows, with monthly inflows reaching $141.5 million at one point. Currently, the circulation of this token is 282,566.

### KAU: Backed by Kinesis & ABX, Market Value of Approximately $160 Million

KAU is launched by Kinesis, a UK digital asset utility platform registered in the Cayman Islands. Each KAU is pegged to 1 gram of investment-grade gold and stored in Kinesis vaults. Slightly different from other gold tokens, KAU supports purchase, trading, consumption, and transfer. In addition to supporting redemption, users holding assets on the Kinesis platform can also earn monthly returns through redistributed transaction fee income; consuming KAU on the Kinesis virtual card can also generate returns. The card supports real-time, instant conversion to buy gold, silver, and cryptocurrencies at more than 80 million locations worldwide.

### XAUm: Backed by Matrixport, Market Value of Approximately $47 Million

In early August, Matrixport announced the official launch of XAUm fixed-income products, supporting investment tenures ranging from 7 to 365 days and 15 major assets including BTC, ETH, SOL, BNB, and USDT. In addition, the Matrixport platform supports XAUm Mint, Swap, and XAUm collateralized lending. The token is issued by Matrixdock, Matrixport’s RWA tokenization platform. Last month, it completed the second annual 100% gold reserve audit conducted by the internationally renowned company CoinVerity, and its gold management scale has increased by 500% in half a year.

### VRO: Backed by VeraOne, Market Value of Approximately $41 Million

VRO is launched by VeraOne, based in London, UK. The project was jointly launched by the AuCOFFRE.com Group and cryptocurrency industry figure Owen Simonin, originally founded in 2019. The token price is currently around $113, with relatively limited liquidity.

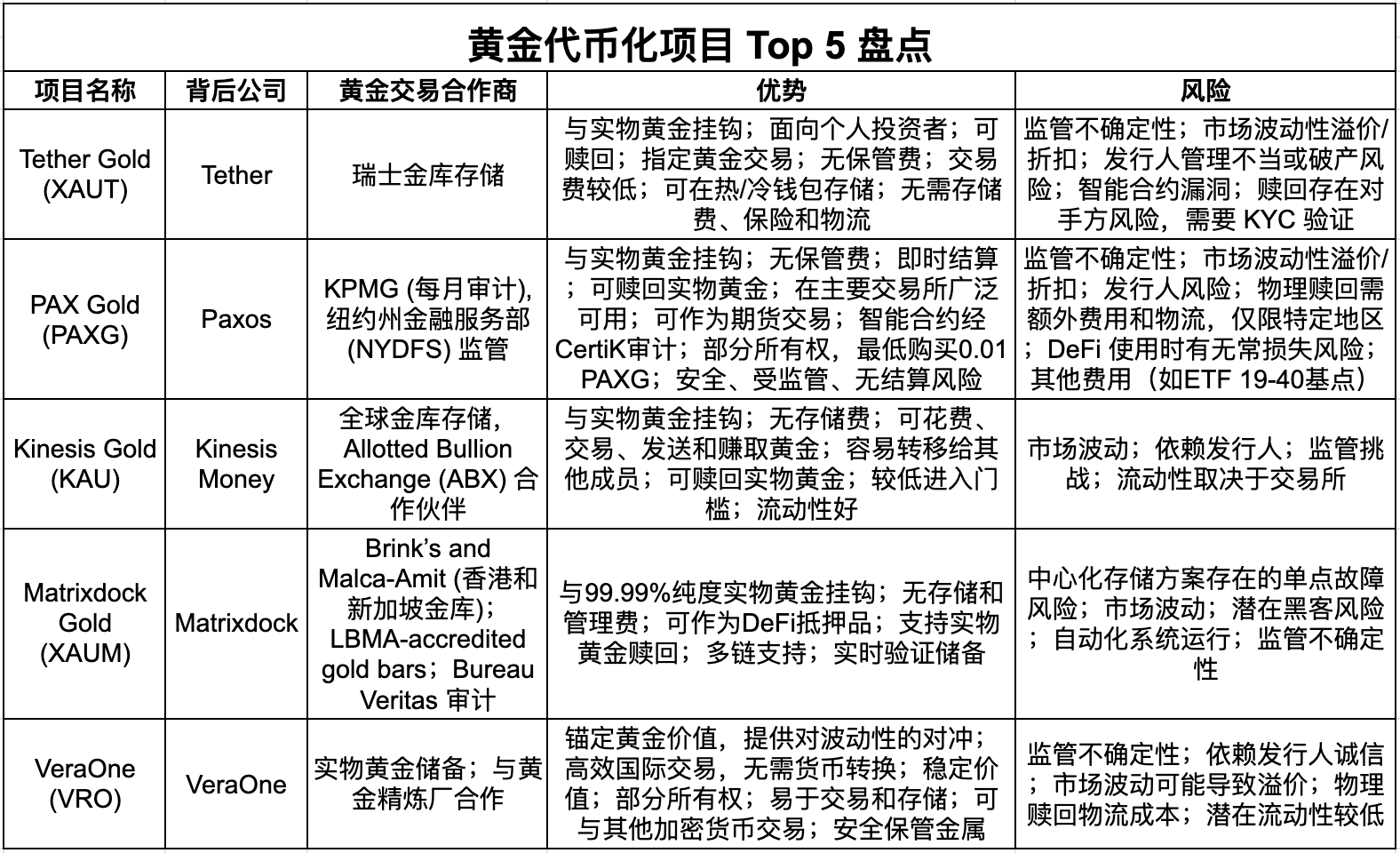

The following is basic information about major projects (compiled from @Grok):

## Conclusion: Gold’s Safe-Haven and Tax-Avoidance Attributes

It is worth noting that the recent record high of gold is closely related to the performance of the U.S. dollar and U.S. Treasury bonds. Ray Dalio, founder of Bridgewater Associates, recently stated that the poor debt situation of the U.S. dollar has indirectly driven up gold prices; international investors have begun to shift from U.S. Treasury bonds to gold. U.S. President Trump stated in a speech in August that "gold will not be taxed."

Today, gold tokens, which combine gold’s safe-haven and tax-avoidance attributes, may become an investment choice for more and more people.

## Disclaimer

The views expressed in this article are solely those of the author and do not constitute investment advice on this platform. This platform makes no guarantee regarding the accuracy, completeness, originality, or timeliness of the information in the article, nor does it assume any responsibility for any losses arising from the use of or reliance on the information contained herein.

Contact: Sarah

Phone: +1 6269975768

Tel: +1 6269975768

Email: xttrader777@gmail.com

Add: 250 Consumers Rd, Toronto, ON M2J 4V6, Canada