X-trader NEWS

Open your markets potential

Ethereum, stablecoins and global financial operating systems

Written by: Maja Vujinovic

Translated by: Shaw, Jinse Finance

My first experience of the power of programmable money didn’t happen on Wall Street or in Silicon Valley, but on the streets of Lagos and São Paulo. Having lived on five continents and worked in mobile payments, I witnessed firsthand how fragile currencies and unreliable banking infrastructure force people to find alternative paths. Later, after acquiring my first bank and collaborating with JPMorgan and General Electric on early enterprise blockchain pilots, I became increasingly convinced that stable, programmable value wouldn’t just complement the existing financial system—it would ultimately rewrite it entirely.

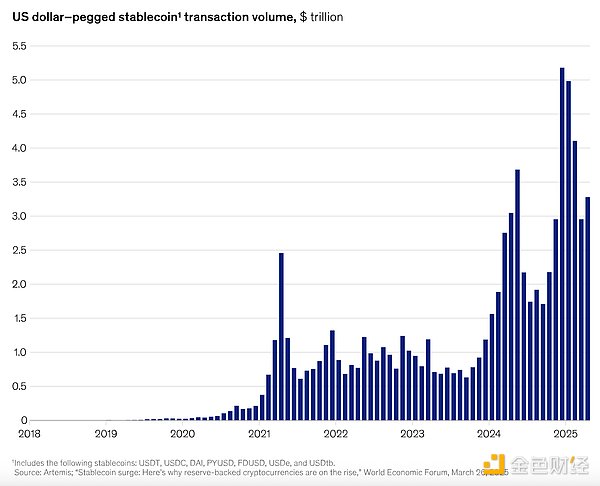

This rewrite is already underway. What once seemed like a fringe experiment is now becoming the foundation of a new financial system. The stablecoin market has reached $260 billion. Tokenization of government bonds, stocks, and real estate is accelerating. And Ethereum, once dismissed as an unruly playground for developers, is now the invisible settlement layer behind open networks and corporate financial experiments.

### Stablecoins as the First Proof of Concept

Stablecoins most clearly demonstrate that tokenization isn’t hype. For hundreds of millions of people—especially in countries grappling with inflation and capital controls—USD-backed stablecoins aren’t speculative; they’re a lifeline. In Argentina, Nigeria, and Turkey, people use USDC and USDT to escape the collapse of their national currencies. In effect, this makes stablecoins the reserve assets of the internet age—a reality often overlooked by regulators in Washington and Brussels, who frame them as narrow compliance challenges.

This geopolitical asymmetry matters. While developed nations debate risks, the rest of the world is adopting stablecoins as de facto infrastructure. And because stablecoins flow most smoothly on Ethereum (which hosts over 50% of supply and 60% of trading volume), every new user strengthens the gravitational pull of the Ethereum ecosystem.

### Tokenization Beyond Buzzwords

The next wave goes far beyond digital dollars. The White House’s recent 168-page strategy report estimates that over $600 billion in assets will be tokenized by 2030—but this figure seems almost trivial given the scale of global markets: $120 trillion in real estate, $100 trillion in equities, $13 trillion in government bonds, and $12 trillion in gold.

I saw this tokenization trend emerging years ago. When platforms like tZERO and later Securitize launched, I advised them to raise significant funding because true mass adoption would take a decade. That moment has finally arrived.

Skeptics are correct that tokenization isn’t new. We’ve seen failed attempts to tokenize artworks and niche securities. But today, the landscape has fundamentally shifted: infrastructure has matured. Custodians like Anchorage, platforms like Securitize, and a robust decentralized finance (DeFi) ecosystem now exist, making tokenized assets practical. A tokenized government bond isn’t just a digital wrapper—it’s collateral that can be instantly transferred, integrated into automated liquidity strategies, or power programmable payments.

This is the real transformation: tokenization turns assets from static stores of value into dynamic snippets of code. Once capital becomes programmable, entirely new financial behaviors emerge. Today, Ethereum hosts 90% of tokenized assets.

### Ethereum as the Settlement Standard

This is why Ethereum matters. It’s not just a blockchain; it’s the programmable settlement infrastructure of this financial internet. Permissionless, censorship-resistant, and already home to most tokenization activity, Ethereum provides the base layer where these new assets can actually interact.

The trend is clear. Even permissioned enterprise blockchains—from JPMorgan’s Onyx to new ventures by fintech giants—keep returning to Ethereum’s design. The Ethereum Virtual Machine (EVM) has become the universal language of programmable finance, much as Microsoft Excel once became Wall Street’s default operating system. Excel created a common grammar for spreadsheets; today, the EVM is doing the same for ledgers: creating a universal grammar of value.

### Corpo-L1s and the EVM Empire

The latest entrants underscore this. Circle launched Arc, a permissioned L1 built for stablecoin finance, operated by a consortium of 20 institutional validators. Stripe is building Tempo, likely using Paradigm’s RETH client, to provide backend settlement for its vast developer ecosystem.

At first glance, these look like dull databases—corporate intranets in marketing drag. But history suggests otherwise. Companies adopting EVM-compatible architectures are effectively tethering themselves to Ethereum’s ecosystem. Even if Arc and Tempo don’t issue tokens today, the gravitational pull of incentives makes it almost certain they eventually will. When they do, developers and liquidity will flock to them—but with Ethereum as the settlement baseline.

This is the overlooked feedback loop: every enterprise L1 (Corpo-L1), even permissioned ones, expands the EVM empire. Just as Excel became indispensable in finance, Solidity developers are now a must-have for any financial institution wanting to stay competitive. In the long run, the accumulated value won’t accrue to the corporate chains themselves, but to the underlying infrastructure they can’t avoid—Ethereum.

### The Geopolitical Layer

Globally, the rise of programmable assets is less about efficiency and more about power. Stablecoins extend dollar hegemony even as nations seek alternatives for trade. The EU talks of “digital sovereignty.”

In this context, Ethereum is more than a blockchain. It’s a neutral public good—a space where all actors—nations, corporations, and individuals—jostle for influence. Just as sea lanes once defined geopolitical power, programmable settlement layers will define a new era of globalization.

### Opportunities and Blind Spots

The real opportunity lies not just in guessing which assets will be tokenized, but in recognizing the shift in logic: capital itself is becoming programmable. This means government bonds can double as collateral, stocks can embed governance, real estate can distribute rental income directly to token holders, and AI agents can manage portfolios in real time.

The blind spot is assuming these changes can be contained within old regulatory and institutional frameworks. They can’t. Once assets flow like information, the focus shifts to the networks that settle them fastest, safest, and most transparently. Today, that’s Ethereum and its scaling solutions.

### Conclusion

After witnessing mobile money take off in emerging economies, helping launch Tether in 2013, and implementing some of the first blockchain pilots with Fortune 50 companies, I see the same pattern repeating globally. Stablecoins have become a parallel system to the dollar. Tokenization isn’t just marketing—it’s capital’s transformation into code. And Ethereum, through the quiet expansion of the EVM, is embedding itself as the operating system of programmable finance.

Wall Street may not realize it, but by hiring EVM developers and building private chains, it’s already neck-deep. Just as no bank could ignore Excel, no financial institution will be able to ignore the EVM. And this shift—from paper to programmable—will be measured not in billions, but in trillions.

Disclaimer: The views expressed in this article are solely those of the author and do not constitute investment advice on this platform. This platform makes no guarantees regarding the accuracy, completeness, originality, or timeliness of the information in the article, nor does it assume any responsibility for losses arising from the use or reliance on such information.

Contact: Sarah

Phone: +1 6269975768

Tel: +1 6269975768

Email: xttrader777@gmail.com

Add: 250 Consumers Rd, Toronto, ON M2J 4V6, Canada