X-trader NEWS

Open your markets potential

Ethereum's

The record 910,000 ETH in Ethereum validator exit queue is mainly driven by Coinbase and Lido. The former withdrew 430,000 ETH due to business restructuring, while the latter continued to rotate validators for technical upgrades.

Author: Luke, Huoxing Finance

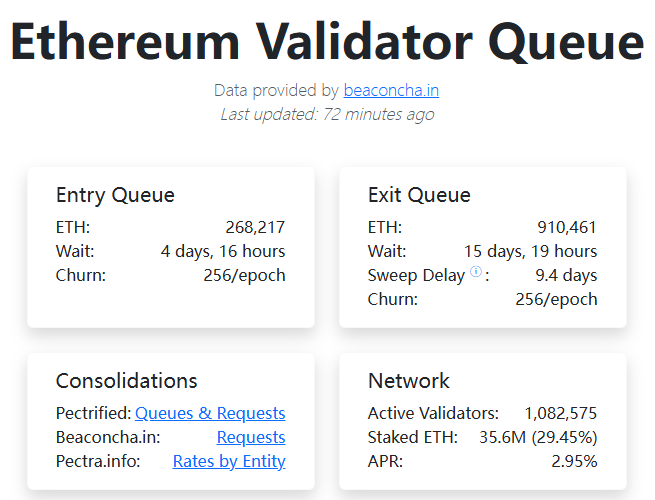

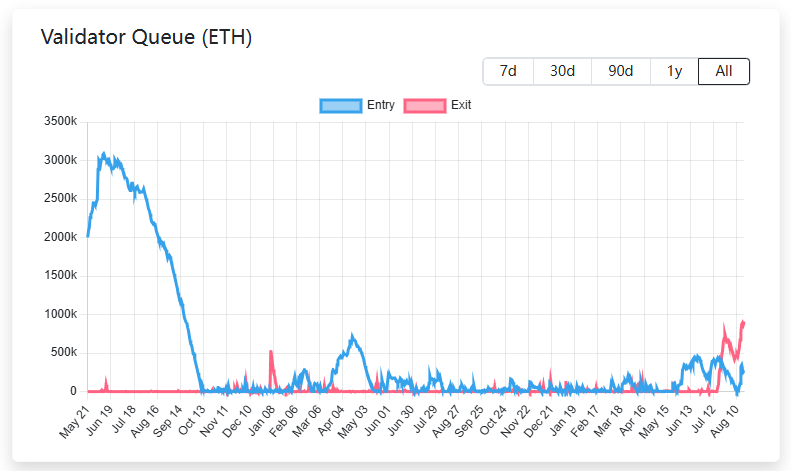

When the number of Ethereum validator exit queues climbed to a record 910,000 ETH (worth nearly $4 billion), the market's instinctive reaction was to find out the reason: was it a panic sell-off or profit-taking? However, the latest evidence reveals a simpler and more impactful answer: this is not a collective action of thousands of retail investors, but a planned turn by several of the largest "whales" in the industry.

This unprecedented wave of exits is not so much a vote of pessimism permeating the market as it is a large-scale back-end infrastructure restructuring led by centralized giants. Understanding this allows us to see through the fog and grasp the truth of the incident.

Understanding the "Queue": A Well-Designed Floodgate

To solve the mystery of this withdrawal wave, we first need to shift our attention from the noisy market to the underlying design of the Ethereum protocol. There, a mechanism called the "validator exit queue" is playing a key role. Rather than being an instant-response ATM, it is more like a precision reservoir dam, whose primary task is to regulate flow rather than meet instantaneous demand.

When a validator decides to stop serving and retrieve its staked 32 ETH, it will not be completed immediately. Instead, it enters an orderly queue. The Ethereum protocol strictly controls the number of validators that can enter and exit the network each day through a mechanism called "Churn Limit". This limit is dynamically adjusted based on the total number of currently active validators.

According to the latest on-chain data, the Ethereum network currently has approximately 1.082 million active validators. Based on the protocol's calculation formula floor (total number of active validators / 65536), only 16 validators are allowed to leave each epoch (about 6.4 minutes). This means that in an ideal state, a maximum of approximately 16 * 225 * 32 = 115,200 ETH can complete exits in a day.

This number is crucial. It tells us that although there is nearly $4 billion worth of ETH backlogged in the queue, it will not flood into the market like a flash flood. On the contrary, this force will be spread over more than 15 days, releasing slowly in a controlled and predictable manner.

The Turn of Whales: Decoding the Real Driver of the Queue Surge

Previous analyses on leveraged liquidation and shifting to re-staking, while explaining part of the background, failed to touch the core of this incident. According to reports from multiple crypto media citing on-chain data, most of the ETH in the queue comes from two sources: Coinbase and Lido.

First and foremost, the largest force comes from Coinbase, the largest cryptocurrency exchange in the United States. According to reports from CoinGape, Watcher.Guru and other media, Coinbase recently launched a large-scale unstaking operation, withdrawing up to 430,000 ETH from its staking pool, worth nearly $1.85 billion. This single operation accounts for nearly half of the entire exit queue. Coinbase explained that this is a "restructuring of its institutional staking services" and an internal business adjustment. This means that these funds are not withdrawn due to bearish market sentiment, and it is more likely that they will re-enter the staking network through new validator addresses after the adjustment is completed.

Second is the "routine operation" of Lido, the largest liquid staking protocol. Reports from The Block indicate that Lido has been implementing a continuous "validator rotation strategy". To adapt to its latest V2 withdrawal standards and improve node performance, Lido's node operators need to regularly exit old validators and start new ones compatible with the new standards. Although the single operation volume of this technical upgrade is not as large as that of Coinbase, its continuity has also contributed a considerable amount to the exit queue.

So, what is the收益 of staking 32 ETH? When discussing the behavior of these giants, it is necessary to understand the basic returns of native staking. According to real-time data from beaconcha.in, the annualized return rate (APR) for independently running a 32 ETH validator node on the Ethereum network is currently about 2.95%. This return comes directly from the protocol itself as a reward for validators maintaining network security and processing transactions. This is a relatively stable but not particularly high rate of return, which explains why the market has derived complex strategies such as liquid staking, leveraged staking, and even re-staking to pursue higher compound returns.

Therefore, the truth of this incident is gradually clear: it is not a collective exit of thousands of independent validators due to market panic or meager returns, but a combination of two major events: Coinbase's one-time large-scale business restructuring and Lido's continuous technical upgrades. Profit-taking by other retail investors and liquidation of small leveraged positions only constitute "background noise" in the queue.

We can see that the nature of the current incident is more like a planned "maintenance" rather than a market-driven "stampede".

Market Impact: Much Ado About Nothing

Since the surge in the queue is rooted in institutional back-end operations, the market's reaction to it should naturally be more rational. Although the headline figure of $4 billion is alarming, the actual impact is likely far less than it sounds.

As we calculated, the maximum daily outflow of approximately 115,200 ETH, at the current price of about $4,300, is equivalent to a potential daily liquidity of nearly $500 million. While this number is not small, it needs to be viewed in a broader context. According to TradingView data, Ethereum's 24-hour spot trading volume on major exchanges is usually between $20 billion and $40 billion. This means that even if these institutions choose to sell after unlocking (which is unlikely), their daily impact will only account for 1.2% to 2.5% of the total trading volume.

The depth and liquidity of the market are likely to absorb this predictable and gradual release. What's more, this batch of funds is unlikely to really flow to the secondary market. Both Coinbase's business restructuring and Lido's technical upgrades aim to re-engage validators in a new and more optimized form.

From a technical analysis perspective, the market has also built corresponding defensive positions. Currently, Ethereum's key support levels are mainly concentrated at $4,200 and $4,000, which are both psychological and technical thresholds. The former is the lower edge of the recent consolidation range, while the latter is an integer level and a key previous Fibonacci retracement level. As long as the price can hold these areas, the bullish structure of the market will not be easily broken. The resistance above is in the $4,500 area and near the all-time high of $4,800.

In conclusion, the record number of Ethereum validator queues has ultimately proven to be a "much ado about nothing" event directed by industry giants behind the scenes. It reveals the pivotal influence of large staking service providers on the network and once again verifies the excellent design of the Ethereum exit queue mechanism in maintaining market stability. For investors, learning to distinguish between the appearance of on-chain data and the truth of the behaviors of the entities behind it is the key to maintaining a clear vision in the increasingly complex crypto world.

Disclaimer: The views in this article only represent the author's personal opinions and do not constitute investment advice for this platform. This platform does not guarantee the accuracy, completeness, originality, and timeliness of the information in the article, nor does it assume any responsibility for any losses caused by the use or reliance on the information in the article.

Contact: Sarah

Phone: +1 6269975768

Tel: +1 6269975768

Email: xttrader777@gmail.com

Add: 250 Consumers Rd, Toronto, ON M2J 4V6, Canada