X-trader NEWS

Open your markets potential

Research on the cyclical law and multi-dimensional driving mechanism of crypto market from 0 to 100 million market value

Looking at the price trend of Bitcoin from 2009 to 2024, it shows significant cyclicality. According to the price range and price trend of Bitcoin, it can be divided into six major development stages. The landmark events at each stage and their far-reaching impacts in shaping the industry ecology are summarized as follows:

Phase 1 (2009-2016): Preliminary market exploration and technical foundation laying

At the beginning of Bitcoin, it was just a test site for niche toys and cryptography enthusiasts in the geek circle. From 2009 to early 2013, its price remained at a low level. However, in 2013, the price of Bitcoin ushered in its first violent fluctuation, soaring from about $20 at the beginning of the year to more than $1,100 at the end of the year, and then fell sharply. This roller coaster-like market has pushed Bitcoin into a global perspective for the first time.

Source: CoinGecko

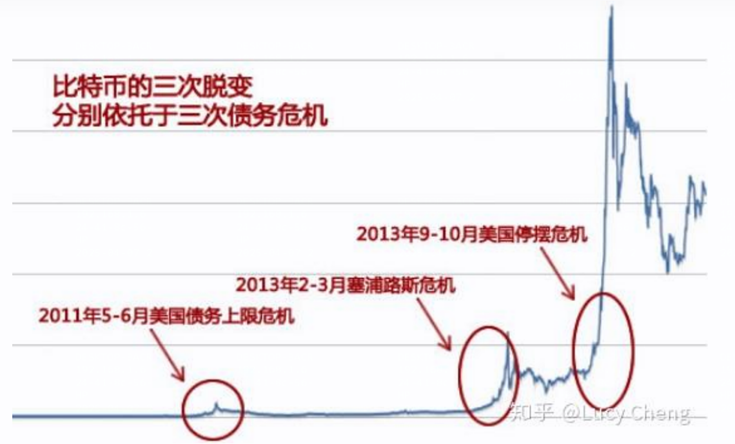

Why did Bitcoin price suddenly soar in 2013? The drivers behind this are as follows:

1. Cyprus Bank Crisis Ignates Risk Avoidance Demand

In March 2013, the Cyprus government announced taxation of bank deposits in exchange for international aid. This radical measure has triggered strong public protests, bank runs and violent market turmoil, deeply exposing the fragility of the traditional financial system and the potential risks of government decision-making.

Against this backdrop, Bitcoin’s decentralized nature and its attributes not under the control of a single government make it widely regarded as a potential safe-haven asset for the first time. Although the circulation and application of Bitcoin was still in its early stages at that time, the Cyprus crisis clearly demonstrated the drawbacks of traditional systems. This event became a catalyst, allowing Bitcoin’s value proposition as an alternative asset, especially its potential hedging attributes, to gain unprecedented market attention and preliminary recognition.

The Cyprus crisis is not an isolated case, it occurs against the macro background of the continued fermentation of the world's sovereign debt crisis. At that time, many countries were deeply in debt difficulties, which triggered widespread concerns about the stability of fiat currencies and wavering in confidence in fiat currencies. This continued uncertain environment has created a breeding ground for non-traditional assets such as Bitcoin.

In fact, looking back at 2013, the price of Bitcoin has risen several times, with timing often closely linked to key risk events in the debt crisis or the intensification of market panic. This shows that the general anxiety about risks in the traditional financial system is a deep and persistent factor driving the surge in Bitcoin demand and price surge that year.

2. Preliminary recognition of regulatory policies

Against the backdrop of the rapid soaring price of Bitcoin, the dynamics of regulatory policies are the weather vane for the future development of the industry. On November 18, 2013, relevant U.S. government held a special hearing on the risks and threats of Bitcoin and other virtual currencies, publicly acknowledging the legitimacy of Bitcoin for the first time.

The clarity of regulatory attitudes instantly ignited market enthusiasm. The day after the hearing (November 19), the price of BTC on Mt.Gox, the world's largest Bitcoin exchange, soared by more than 114% in a single day from about US$420 before the hearing, breaking through the $900 mark in one fell swoop, and soon after that, hitting a record high at that time. The surge caused by regulatory policies this time clearly demonstrates the huge driving effect of regulatory recognition on market confidence and capital inflows.

3. Mainstream media coverage

In 2013, Bitcoin completely "breaks the circle" from the technical geek circle and becomes the focus of mainstream media around the world. Major media scramble to report that reports on the surge in Bitcoin prices, early investors' wealth and its subversive potential are overwhelming. This greatly stimulated the public's investment interest and speculative enthusiasm, and countless new investors flocked to the market due to FOMO sentiment, forming a strong buyer's power.

However, in 2013, when regulatory favorable and market sentiment is high, why did the Bitcoin price not continue to soar, but entered a downward cycle in 2014?

1. Regulatory risks appear

In the window period lacking a strict regulatory framework, dark webs (such as the Silk Road) have boomed with Bitcoin. As an untrackable breeding ground for illegal transactions, the dark web has flooded money laundering, drug and contraband transactions have forced regulators to face up to the potential harm of cryptocurrencies. The landmark event was the FBI's seizure of the first generation of "Silk Road" in October 2013. This action not only hit the dark web ecosystem hard, but also sent a clear signal to the market: Bitcoin is not a lawless place.

2. China's regulation tightens

On December 5 of the same year, the People's Bank of China issued the "Notice on Preventing Bitcoin Risks", prohibiting financial institutions from providing Bitcoin-related services. This has curbed Bitcoin’s financial application in China, resulting in a sharp decline in Bitcoin’s price in the short term.

3. Exchange trust crisis

On February 28, 2014, the Mt.Gox exchange announced bankruptcy and a large amount of Bitcoin loss, raising widespread global concerns about the security and regulation of the exchange. Bitcoin price fell further.

Stage Features: Bitcoin’s decentralized characteristics are significantly reflected in the first phase, just like the “peer-to-peer electronic cash system” defined in the Bitcoin white paper, its censorship resistance and independent sovereignty have been verified in the real world. At the same time, the early immature ecology also exposed its vulnerability to regulatory absence.

Phase 2 (2016-2018): ICO fanaticism and heavy supervision

来源:CoinGecko

The breakthrough of the crypto ecosystem

On July 20, 2015, the main Ethereum network was launched. The smart contract and decentralized application framework it introduced expanded blockchain technology from a single payment scenario to the entire ecosystem of finance, gaming, social networking, etc., marking the official start of the technological revolution of the value Internet.

While technological innovation, Bitcoin’s internal mechanism has begun to make efforts: the second block reward will be halved on July 9, 2016. The expectation of scarcity combined with the incremental funds brought by the Ethereum ecosystem has jointly pushed the market out of the trough at the end of 2016 and started a new round of recovery cycle.

With the maturity of Ethereum smart contract technology, the global ICO market showed explosive growth in 2017. As of the end of November of that year, a total of 430 ICO projects were born around the world, with a total financing of US$4.6 billion. Taking the Chinese market as an example, the 2017 research briefing of the National Institute of Finance of Tsinghua University showed that the scale of domestic ICO financing reached 2.6 billion yuan in the first half of the year alone, and more than 100,000 investors participated, reflecting a significant increase in market participation.

The rise of this craze stems from both drivers

For project parties, ICO provides financing channels to circumvent the strict review of traditional IPOs, and only basic technical documents can be used to raise funds, while avoiding equity dilution issues;

For ordinary investors, low thresholds to participate in early-stage projects and obtain short-term premium returns after token listing constitute a strong speculative motivation.

However, market expansion is accompanied by the accumulation of systemic risks. ICO projects generally lack information disclosure mechanisms and qualification review standards, and there are no clear regulations on the scale of fundraising and circulation methods. In the absence of regulatory supervision, the scope of financing has expanded from the disorderly development of core blockchain technology to the Internet of Things, gambling, social media and other fields. What’s more serious is that the technical security risks of smart contracts continue to be exposed, further amplifying market risks.

Regulatory punches and market turnarounds

In response to the above chaos, on September 4, 2017, the People's Bank of China and seven ministries issued the "Announcement on Preventing the Risk of Token Issuance Financing", which clearly characterized ICO as illegal public financing. The ban requires domestic cryptocurrency exchanges to completely stop trading and close their platforms before September 15, which directly led to a cliff-like decline in the trading volume of the virtual currency market and a sharp decline in Bitcoin prices simultaneously. This regulatory action marks a global change in governance paradigm for decentralized financing.

Stage characteristics: In the second phase, we can see that Ethereum’s technological innovation drives explosive growth in the market. However, the absence of macro-regulation leads to risk accumulation, which reveals the two-way role of the macro-power mechanism, that is, technology and innovation provide momentum for market growth, and the reconstruction of the regulatory system guides the direction of market correction.

Phase 3 (2018-2020): Market clearance and institutional ice breaking

来源:CoinGecko

In-depth callback and market clearance

After the bursting of the ICO bubble in 2017, the Bitcoin market entered a deep pullback cycle in 2018. With the bankruptcy liquidation of a large number of projects, prices continued to be under pressure. By early 2020, the price of Bitcoin remained in the $10,000 range. The core turning point of this stage lies in the entry of traditional capital and compliance institutions, which has laid the foundation for a new bull market and eventually triggered a wave of innovation in decentralized finance (DeFi) in the summer of 2020.

Institutional admission

On June 18, 2019, Facebook officially released the Libra stablecoin white paper, trying to build a global digital currency payment network. This subversive challenge to the traditional financial system was ultimately shelved due to political encirclement from global regulators.

On January 21, 2020, Grayscale Bitcoin Trust completed the registration of the US Securities and Exchange Commission (SEC), becoming the first cryptocurrency investment vehicle regulated by the SEC. Michael Sonnenshein, general manager of the company, stressed: "Grayscale voluntarily accepts this appointment and will continue to work within the existing regulatory framework. Today's statement should send a signal to investors that our regulators are willing to participate in our products and the entire (cryptocurrency) industry." This move provides a compliant deposit channel for institutional capital, significantly lowering the allocation threshold.

On August 11, 2020, MicroStrategy purchased 21,454 bitcoins for the first time for $250 million. Now (in 2025), MicroStrategy has become one of the largest companies in the world to openly hold Bitcoin. MicroStrategy's strategy for Bitcoin has completely changed the way companies think about financial management and has transformed the industry's attitude towards digital assets.

Stage characteristics: The third stage is a critical period for market self-healing and transformation. In the bear market where the ICO bubble burst, inferior projects were washed out. The entry of real-world institutions provides an institutional path for the crypto market, which also paves the way for the next stage of market explosion.

Phase 4 (2020-2022): Defi expansion, NFT outbreak and regulatory differentiation

来源:CoinGecko

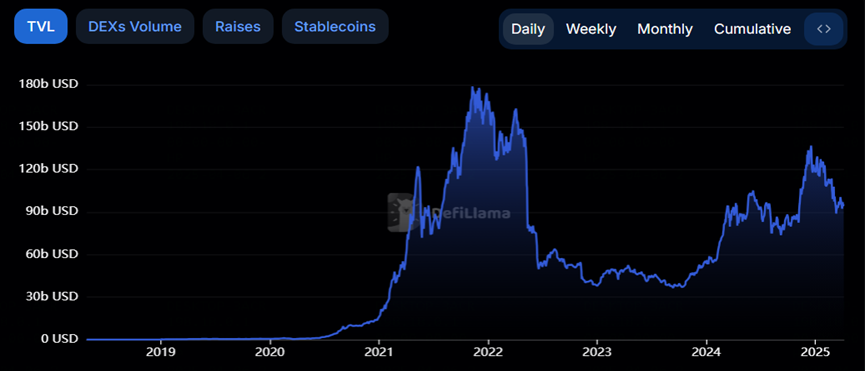

DeFi ecosystem grows exponentially

Based on the composability innovation of Ethereum smart contracts, Decentralized Finance (DeFi) started its explosive cycle in the summer of 2020. Core indicators show exponential growth. According to DeFi Llama statistics, the total value of locked stocks in the industry (TVL) soared from about US$15 billion at the beginning of 2021 to a peak of nearly US$180 billion at the end of the same year, an annual increase of 1,100%. Thousands of protocols emerging in this process reshape traditional financial logic, with representative projects with infrastructure significance including:

Mortgage loan agreement Compound

Automated market maker Uniswap

Stable Coin System USDT

Decentralized oracle ChainLink

Synthetix

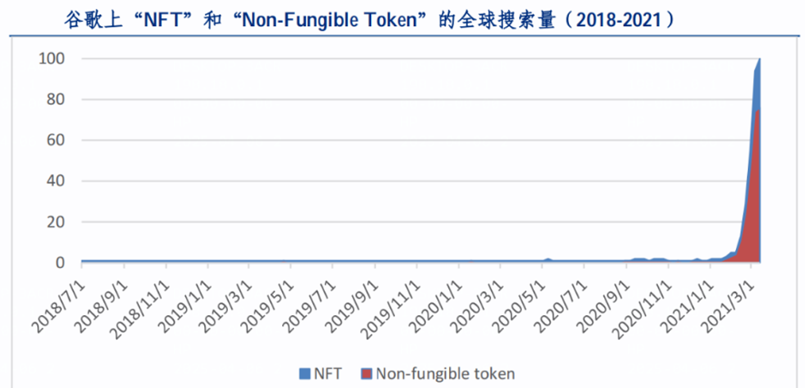

NFT market explodes

During the same period, the non-fungible token (NFT) market completed the leap from technical experiments to mainstream consumption scenarios. Its core breakthrough lies in realizing the unique on-chain rights confirmation of digital content through the ERC-721/1155 standard, and giving birth to trillion-level emerging markets such as artworks, collectibles, and virtual real estate. Typical cases such as CryptoPunks, BAYC and Decentraland mark a fundamental shift in the ownership economic paradigm.

Global regulatory stances significantly differentiate

In the fourth stage, the stance of national regulators on cryptocurrencies is differentiated:

China

May 2021: The Financial Stability and Development Committee of the State Council clearly requires "cracking down on Bitcoin mining and trading behaviors", and clearance of key mining towns such as Inner Mongolia and Xinjiang will be carried out;

September 2021: The People's Bank of China and ten other ministries issued the "Notice on Further Preventing and Handling the Risk of Speculation in Virtual Currency Transactions", characterizing virtual currency-related businesses as "illegal financial activities" and completely prohibiting the provision of domestic services.

El Salvador

On June 8, 2021, the Legislative Assembly of El Salvador voted to identify Bitcoin as an unrestricted fiat currency, making the Republic of El Salvador the first country to formally adopt cryptocurrencies.

USA

On October 15, 2021, the U.S. Securities and Exchange Commission (SEC) approved the listing of the ProShares Bitcoin Futures ETF (code: BITO). This move marks the first time that the traditional financial system has accepted cryptocurrency derivatives and opened up a standardized channel for institutional capital allocation.

Stage characteristics: Technological innovation drives the unprecedented prosperity of the market, but the pressure on regulatory adaptability reconstruction has increased significantly after the peak of the bull market, and the regulatory paths of various countries show significant differences.

Stage 5 (2022-2024): Black Swan Impact and Governance Reconstruction

来源:CoinGecko

Serial risk events and deep depression

Under the impact of chain risk events such as the LUNA collapse, Celsius bankruptcy and FTX bankruptcy, the cryptocurrency market fell into a deep downturn in 2023. Bitcoin price has continued to decline since the end of 2022 and has fallen below $20,000 by the beginning of 2023.

The Terra ecosystem collapsed in May 2022, causing its algorithmic stablecoin UST to seriously dean the anchor, which also destroyed the value of LUNA tokens. The event triggered a systematic reflection on the economic model of decentralized stablecoin. Panic spread to the entire stablecoin market, and mainstream stablecoins such as USDT were once under pressure to run.

Celsius, one of the first crypto institutions to be implicated by the TerraUSD and Luna crashes, filed for bankruptcy in July 2022. This forces regulators to accelerate the formulation of regulatory requirements for lending platforms.

The bankruptcy of the FTX exchange in November 2022 triggered a crisis of trust on the exchange and became a black swan that overwhelmed market confidence. At this point, the market has put forward higher requirements for the transparency and trust of the exchange, which has promoted the industry's reflection and improvement.

Stage characteristics: The series of black swan events expose the industry's problems in risk management, transparency and governance. The market enters a bear market, forcing the market to conduct painful but necessary clearance, and promoting the industry's reflection and upgrading of security, transparency and regulatory compliance.

Stage 6 (2024-2025): Institutional breakthroughs and macro-narrative resonance

来源:CoinGecko

Market Recovery and Historic Breakthroughs

Driven by both regulatory compliance and a shift in monetary policy, the cryptocurrency market achieved historic breakthroughs in 2024. The price of Bitcoin surpassed the $100,000 mark for the first time, Ethereum significantly enhanced Layer 2 scalability through the Cancun upgrade, and the meme coin sector also experienced explosive growth.

In January 2024, the U.S. Securities and Exchange Commission (SEC) approved the listing of 11 BTC spot ETFs, allowing massive inflows of capital from traditional institutions into the crypto market and further promoting the compliant development of the crypto space. In May of the same year, Ethereum spot ETFs were approved.

In September 2024, the Federal Reserve cut interest rates by 50 basis points for the first time in four years. This move facilitated the transfer of funds from traditional markets to high-risk assets, injecting substantial liquidity into the crypto market.

In November 2024, Donald Trump was elected U.S. President. His public stance in support of cryptocurrencies prompted Bitcoin's price to break through $100,000.

Phase Characteristics: Institutional breakthroughs resonated with macroeconomic policies and political narratives, driving the market into a new institutional-led, more compliant growth cycle.

Summary

Through several growth cycles of Bitcoin's price, we can gain some insight into the operating laws of the cryptocurrency market. The cryptocurrency market follows a cyclical pattern: "outbreak of technological innovation → market speculation frenzy → regulatory intervention → in-depth market correction → underlying technology iteration". Among them, the factors affecting the market are diverse and interrelated, with core factors including the following:

- Technological Innovation and Ecological Development: Continuously expanding application scenarios such as Ethereum smart contracts, DeFi protocols, NFTs, and GameFi are among the core drivers attracting funds and users. Meanwhile, Bitcoin's halving every four years has long supported upward price expectations by reducing supply.

- Market Sentiment and Speculative Drivers: The emergence of new narratives, technological and ecological development, coupled with rising coin prices, amplify users' FOMO (fear of missing out) sentiment, triggering speculative frenzies and driving price increases.

- Regulatory Policies and Compliance Processes: Policy changes such as China's ban on ICOs, El Salvador's adoption of BTC as legal tender, and the U.S. approval of BTC futures ETFs and spot ETFs directly affect market confidence and capital flows. Strict regulation suppresses the market in the short term, but compliance ultimately clears the way for large-scale institutional capital inflows, promoting market standardization and mainstream adoption.

- Institutional and Capital Entry: Channels such as Grayscale Trust, MicroStrategy, and spot ETFs have lowered the threshold for traditional capital entry. Their large-scale influx provides stability endorsement and continuous liquidity for the market.

- Macroeconomic and Political Environment: Global monetary policies, geopolitical risks, major political events, and leaders' policy tendencies significantly amplify market volatility. Cryptocurrencies are increasingly showing their potential as macro hedging tools.

- Black Swan Events and Market Corrections: The collapse of Mt.Gox, LUNA, and FTX's bankruptcy triggered trust crises and bear market corrections. However, crises prompt market reflection, eliminate inferior projects, and drive improvements in safety, transparency, and governance standards, laying the foundation for the next round of healthy development.

At the same time, we can find that:

- The cryptocurrency market follows a spiral cycle. Each cycle eliminates inferior projects and ecosystems, while accumulating high-quality value.

- Breakthroughs in blockchain technology and ecological expansion are the core engines for long-term value growth in the cryptocurrency market.

- Regulatory policies are a double-edged sword for market development. The ultimate compliance process (such as spot ETFs) is a necessary path to attract institutional capital and achieve mainstream adoption, marking a leap in market maturity.

- The impact of the global macroeconomy, monetary policies, and geopolitics on the volatility of the crypto market is increasingly significant, and cryptocurrencies are increasingly showing their attributes as a new type of asset class with macroeconomic relevance.

- Although black swan events cause short-term pain, they objectively accelerate the standardization of the industry in terms of security, transparency, and governance.

Standing at the starting point of a new cycle in 2025, the tokenization of real-world assets (RWA) has emerged as a bridge connecting traditional finance and on-chain ecosystems, indicating that the market focus may shift from speculative frenzy to more substantial value creation. In the foreseeable future, the cryptocurrency market will enter a new era of dual-wheel growth driven by institutional innovation and continuous technological breakthroughs!

Disclaimer: The views in this article are solely those of the author and do not constitute investment advice on this platform. This platform makes no guarantees regarding the accuracy, completeness, originality, or timeliness of the information in the article, nor shall it be liable for any losses arising from the use of or reliance on the information contained herein.

Contact: Sarah

Phone: +1 6269975768

Tel: +1 6269975768

Email: xttrader777@gmail.com

Add: 250 Consumers Rd, Toronto, ON M2J 4V6, Canada