X-trader NEWS

Open your markets potential

When US debts worth 100 billion find a

### Writing: White55, Mars Finance

## I. Legislative Process: A Dramatic Turn from "Near Death" to "Resurrection"

From May to June 2025, the博弈 (game) in the U.S. Senate over the GENIUS Act (full name: Guiding and Establishing a National Innovation Act for U.S. Stablecoins) can be called an epic battle interweaving politics and finance. This bill, aiming to establish the first federal regulatory framework for the $250 billion stablecoin market, experienced a thrilling reversal from "procedural death" to "bipartisan compromise" and finally advanced to the full Senate debate stage with a vote of 68 to 30. However, behind this victory lies months of interest exchanges between the two parties, lobbying battles among industry giants, and ethical controversies sparked by the Trump family's "crypto gold mine".

### Timeline Review:

- March 2025: Republican Senator Bill Hagerty formally introduced the initial draft of the bill, aiming to establish a "federal + state" dual - regulatory system for payment - type stablecoins.

- May 8: The first procedural vote on the bill unexpectedly failed with a result of 48:49. The Democratic Party collectively defected on the grounds of "conflict of interest of the Trump family".

- May 15: The two parties held urgent consultations and introduced a revised version of the bill, removing provisions targeting the Trump family's crypto business in exchange for partial support from the Democratic Party.

- May 20: The amendment passed the crucial "Cloture Vote" with a result of 66:32, clearing the legislative obstacles.

- June 11: The Senate passed the bill with an overwhelming advantage of 68:30, entering the final debate and amendment process.

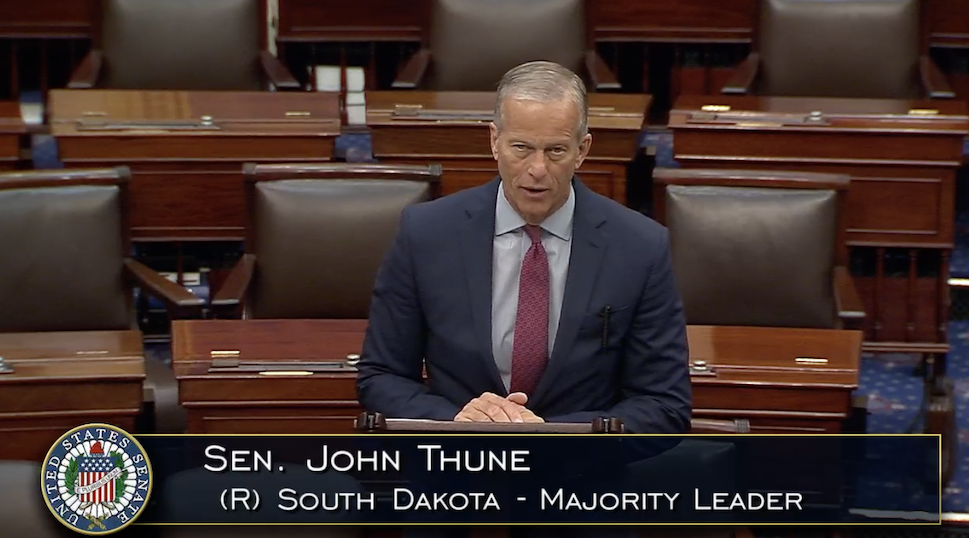

Senate Majority Leader John Thune delivered a speech on Wednesday in support of the vote to pass the GENIUS Act. Source: U.S. Senate

The core of this series of turns lies in the Republicans' clever packaging of the bill as a strategic tool for "the digital dollar's hegemony". Meanwhile, there was a loosening of positions within the Democratic Party due to concerns about "financial risks caused by regulatory vacuum". The lobbying words of Senate Majority Leader John Thune were highly incendiary: "If the United States does not dominate the stablecoin rules, China will fill the gap with the digital yuan!"

## II. Core Provisions: Regulatory Blueprint and "Devil in the Details"

The regulatory framework design of the GENIUS Act attempts to walk a tightrope between "encouraging innovation" and "preventing risks". Its core provisions can be summarized into the following six pillars:

### Dual Regulation and Issuance Thresholds

Stablecoins with an issuance scale exceeding $10 billion are subject to federal regulation (led by the Office of the Comptroller of the Currency, OCC). Those with an issuance scale below $10 billion can choose state - level regulation, but state standards must be consistent with federal ones. This design both appeases the autonomy of each state and draws a red line for giants, and is regarded as a disguised protection for Circle (USDC) and Tether (USDT).

### 1:1 Reserve and Asset Segregation

It is mandatory that stablecoins be fully collateralized with highly liquid assets such as cash and short - term U.S. Treasuries, and reserve assets must be strictly segregated from operating funds. This provision directly targets the 2022 Terra collapse incident, but allowing "risky assets" such as money market funds to be included in the reserves has been criticized as "planting a mine".

### "Bridle" for Tech Giants

Non - financial technology companies (such as Meta, Google) issuing stablecoins need to go through the approval of the newly established "Stablecoin Certification Review Committee (SCRC)" and meet data privacy and anti - monopoly requirements. This provision is interpreted as a "targeted strike" against Musk (X platform's stablecoin plan), an ally of Trump.

### Consumer Protection and Bankruptcy Priority

In case of the issuer's bankruptcy, stablecoin holders can redeem their assets on a priority basis, and the reserve funds are not included in the bankruptcy estate. However, the Democratic Party pointed out that this provision is weaker than the traditional bank FDIC insurance mechanism and has the risk of "freezing funds".

### Anti - Money Laundering and Transparency

Stablecoin issuers are brought under the jurisdiction of the Bank Secrecy Act, and are required to fulfill obligations such as KYC (Know Your Customer) and suspicious transaction reporting. But there is a loophole: Decentralized exchanges (DEX) are not bound, leaving a backdoor for illegal fund flows.

### "Exemption Loophole" for the Presidential Family

The bill does not explicitly prohibit members of Congress or the president's relatives from participating in stablecoin business. The USD1 stablecoin (with a market value of $2 billion) issued by World Liberty Financial (WLF) under the Trump family has thus been legalized. Democratic Senator Warren angrily criticized: "This is giving the green light to Trump's 'crypto corruption'!"

## III. Controversy Vortex: Trump's "Crypto Gold Mine" and Bipartisan Division

The biggest resistance to the advancement of the bill does not come from policy details, but from the conflict of interest caused by the Trump family's deep involvement in the crypto industry. Three major controversial points have pushed the political game to a climax:

### "Legalized Arbitrage" of the USD1 Stablecoin

The USD1 issued by WLF has injected $2 billion into Binance through an Abu Dhabi investment company. The Trump family can earn more than $80 million annually through transaction fees. More fatally, after the bill is passed, USD1 will automatically obtain federal recognition, and its market value may soar to the tens of billions of dollars level.

### Ethical Crisis of "Pay to Meet"

Trump sold Meme coins (such as TRUMP Coin) to provide holders with the qualification for a "presidential dinner", which was accused by the Democratic Party of "securitizing state power". Senator Merkley (Jeff Merkley) bluntly said: "This is the most naked exchange of power for money in history!"

### "Revolving Door" of Legislative and Executive Powers

One of the core drafters of the bill, Republican Senator Hagerty, was exposed to have a connection of political donations with WLF. The Democratic Party tried to promote an amendment to prohibit public officials from participating in stablecoin business, but was collectively blocked by the Republican Party.

Although the two parties reached a compromise on May 15 and removed provisions directly targeting Trump, Warren and others still launched a "last stand" in the Senate, demanding the disclosure of the fund flows between the Trump family and WLF. This ethical offensive and defensive battle is actually a prelude to the 2026 mid - term elections.

## IV. Market Turmoil: Compliance Dividends and the "Oligarch Era"

If the GENIUS Act is finally implemented, it will trigger a structural reshuffle in the stablecoin market:

### "Lying - down Win" for Head Players

USDC (Circle) and USDT (Tether) will directly obtain federal licenses because they have already laid out compliant reserves (80% are short - term U.S. Treasuries), further squeezing small and medium - sized issuers. Goldman Sachs predicts that their market share may rise from 94% to 98%.

### "Cross - border Harvest" by Traditional Finance

Institutions such as JPMorgan Chase and Wells Fargo have applied for "limited - purpose stablecoin licenses" and plan to encroach on the share of cryptocurrency exchanges through on - chain payment business. The provision in the bill "allowing insurance companies to issue stablecoins" has opened the door for traditional giants.

### "Antidote or Poison" for the U.S. Debt Crisis?

The bill requires that stablecoin reserves be mainly in U.S. Treasuries. In the short term, it may ease the U.S. debt liquidity crisis, but in the long term, it may exacerbate the "maturity mismatch" - investors prefer short - term bonds, leading to a shrinking demand for long - term U.S. Treasuries and a further deterioration of the fiscal deficit.

### "Domino Effect" of Global Regulation

The European Union, the United Kingdom, and Singapore have stated that they will adjust their policies with reference to the GENIUS Act, forming a "U.S. Dollar Stablecoin Alliance". Yuan and yen stablecoins may be squeezed out of the cross - border payment market, reshaping the global currency pattern.

## V. Future Battle: House of Representatives Game and Trump's "Final Ruling"

Although the Senate has given the green light, the bill still needs to pass through three hurdles:

### "Simplified Clearance" in the House of Representatives

The Republican Party controls the House of Representatives with a 220:215 majority and only needs a simple majority (218 votes) to pass the bill. However, there are key differences between the House version of the STABLE Act and the Senate version: the former requires that regulatory power be completely under the federal government and prohibits technology companies from issuing stablecoins. The coordination between the two houses may be delayed until before the August recess.

### "Interest Balance" by the President

Although Trump publicly supports the bill, his family's interests are deeply bound to the legislative details. If the Democratic Party promotes an "anti - corruption amendment" in the House of Representatives, it may trigger the president's veto power and lead to the abortion of the legislation.

### "Grey Rhino" of Judicial Challenges

The U.S. Constitution's "Emoluments Clause" prohibits the president from profiting from foreign governments. And 20% of the users of USD1 are in countries on the sanctions list (Iran, North Korea), which may trigger the intervention of the Supreme Court.

## VI. Conclusion: "Dollar Hegemony 2.0" in the Crypto Era

The ultimate ambition of the GENIUS Act is by no means just to regulate the market, but to implant the dollar hegemony into the genes of the blockchain. By binding U.S. Treasuries and stablecoins, the United States is building a "digital dollar empire" - every on - chain transaction in the world implicitly consolidates the reserve status of the dollar. However, the risks of this huge gamble are also enormous: If DeFi (decentralized finance) bypasses compliant stablecoins, or China accelerates the internationalization of the digital yuan, the bill may become a "House of Cards".

The game of politicians, the lobbying of interest groups, and the frenzy of technological revolution - at this historical crossroads, the final fate of the GENIUS Act will determine who dominates the financial order of the next decade.

### Disclaimer: The views in this article only represent the author's personal opinions and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness, originality, and timeliness of the article information, nor shall it be liable for any losses caused by the use or reliance on the article information.

Contact: Sarah

Phone: +1 6269975768

Tel: +1 6269975768

Email: xttrader777@gmail.com

Add: 250 Consumers Rd, Toronto, ON M2J 4V6, Canada