X-trader NEWS

Open your markets potential

Ethereum's Countdown to $3,000, under 40 billion open contracts, 1.8 billion shorts are queuing up to explode their positions

**Prologue: Price Breakthrough and Whale Maneuvers**

On June 10, 2025, Ethereum's price surged past $2,827 in a sharp offensive, hitting a 15-week high. Behind this figure, a liquidation storm involving $1.8 billion in short positions was brewing. In this seemingly accidental market move, the operational trajectory of a mysterious whale became the key footnote for interpreting market sentiment.

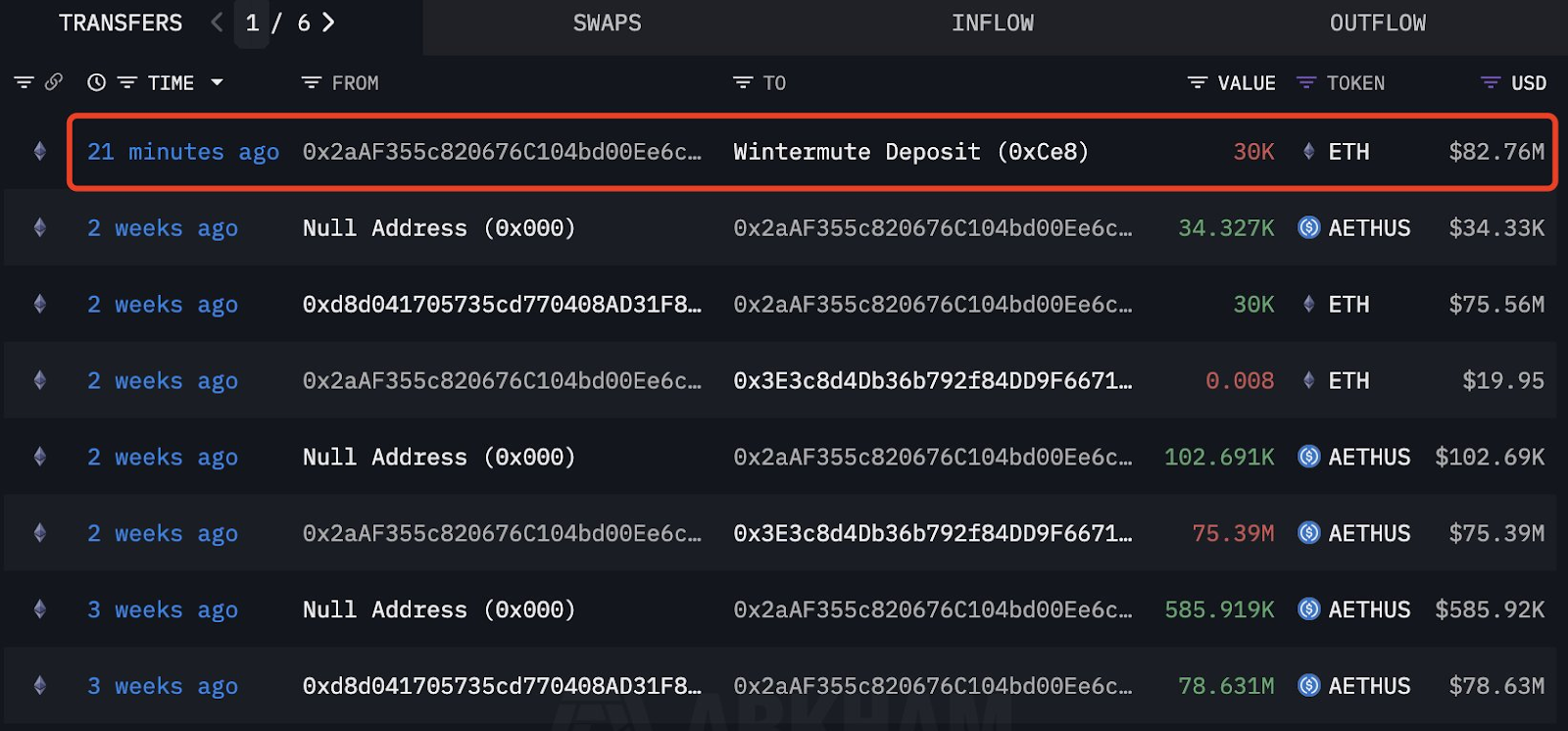

**ETH Whale Trading Activities.** Source: Lookonchain/X

According to the on-chain tracking platform Lookonchain, an anonymous address completed two precise snipes within 44 days:

- **First Round (April 27)**: Accumulated 30,000 ETH at an average price of $1,830 through Wintermute OTC, costing $54.9 million.

- **Second Round (May 27)**: Sold an equal amount of tokens at $2,621, profiting $23.73 million with a yield of 43%.

- **Final Harvest (June 10)**: Sold 30,000 ETH again via OTC trading for $82.76 million, locking in $7.3 million in profits—cumulatively reaping $31 million.

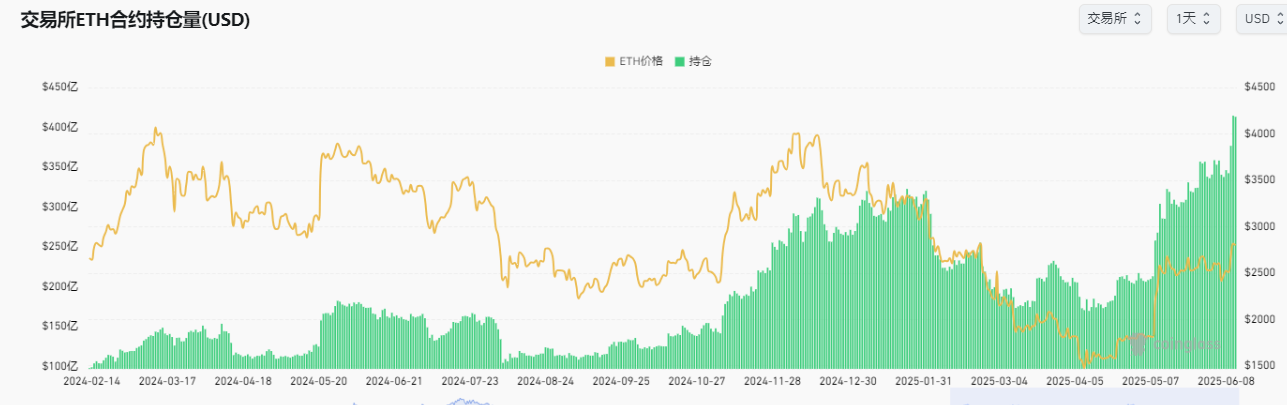

Such operations are no exception. CoinGlass data shows that Ethereum futures open interest (OI) has突破 (broken through) the $40 billion mark for the first time, with market leverage approaching a critical point. The current liquidity landscape presents a delicate balance: $2 billion in long liquidation risks gather near $2,600, while $1.8 billion in short positions lie dormant above $2,900. This bull-bear standoff mirrors the CDO market in *The Big Short*—any directional breakthrough could trigger a chain reaction.

**Chapter 2: Ecological Expansion and Value Cracks**

Behind the price frenzy, the Ethereum ecosystem is undergoing structural changes.

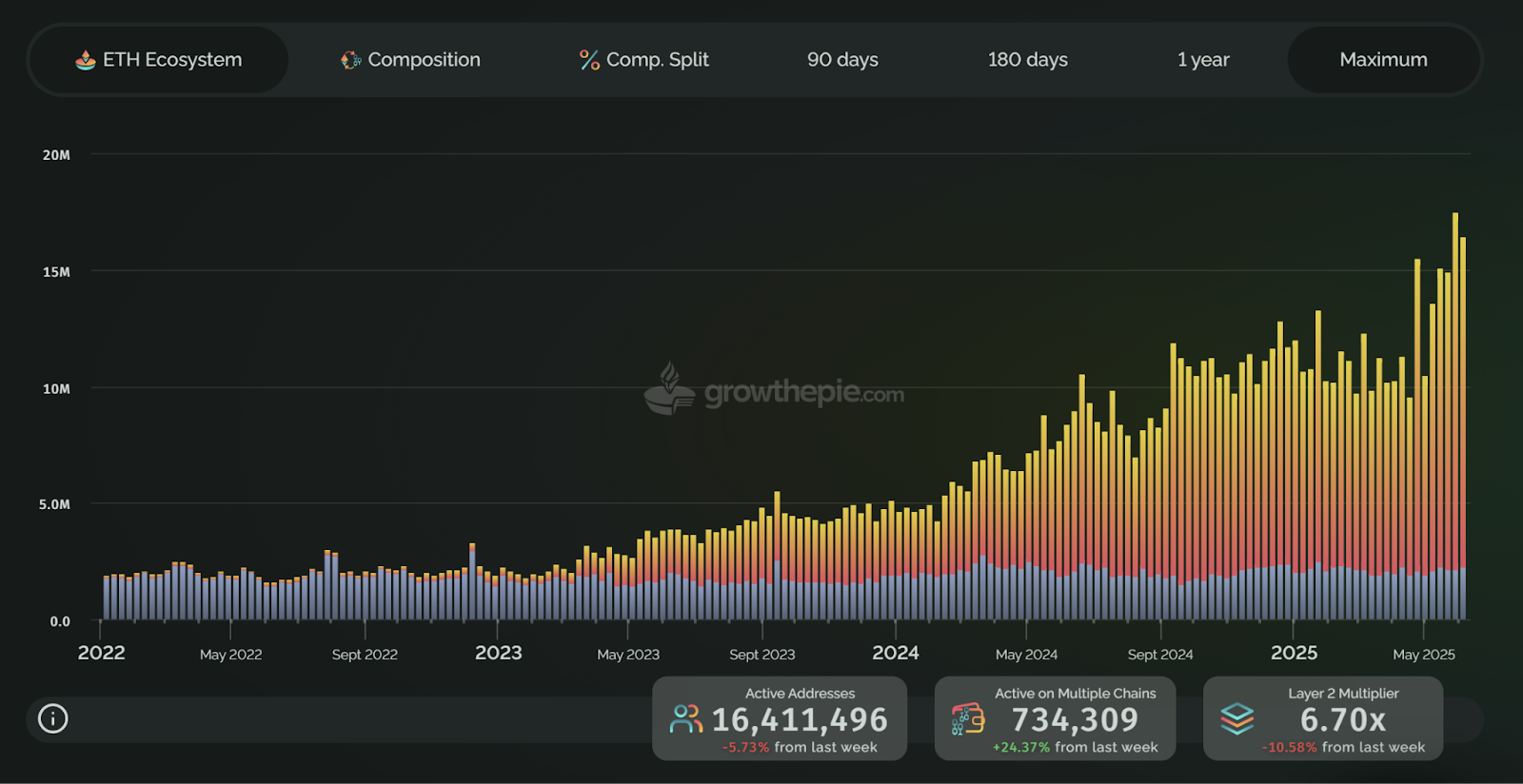

Ethereum Weekly Address Participation Chart. Source: growthepie

Growthepie data shows that independent active addresses surged by 70% in Q2, peaking at 16.4 million on June 10. The Base network became the growth engine with a 72.81% share (11.29 million addresses), far exceeding the Ethereum mainnet's 14.8% (2.23 million addresses). This model of "satellite chains feeding back to the mainnet" differs entirely from the DeFi Summer narrative of the 2020s.

Although Ethereum still holds a 61% share of the DeFi market with $66 billion in TVL, its core revenue model shows hidden concerns:

- **Plunging Transaction Fees**: Network fees in the past 30 days were only $43.3 million, a 90% nosedive from before the Cancun upgrade.

- **Staking Yield Dilemma**: While Blob technology reduces Layer2 costs, stakers' annualized returns have persistently languished at 3.12%, far below rivals like Solana.

- **Regulatory Shackles**: The SEC's review of ETH staking led to 8 consecutive days of net outflows of $369 million from spot ETF funds, cracking institutional confidence.

This contradiction is visualized in Glassnode's on-chain data: the proportion of "diamond hands" (addresses holding ETH for over 1 year) plummeted from 63% to 55%, while short-term holders' selling volume surged by 47%. When technological upgrades fail to translate into returns for holders, ecological prosperity instead becomes a driver of value dilution.

**Chapter 3: The Blood-Soaked Compass of the Derivatives Market**

Undercurrents surge in the futures market. ETH futures open interest (OI) has broken through $40 billion for the first time in history, indicating high market leverage. The sharp rise in open interest signals potential volatility.

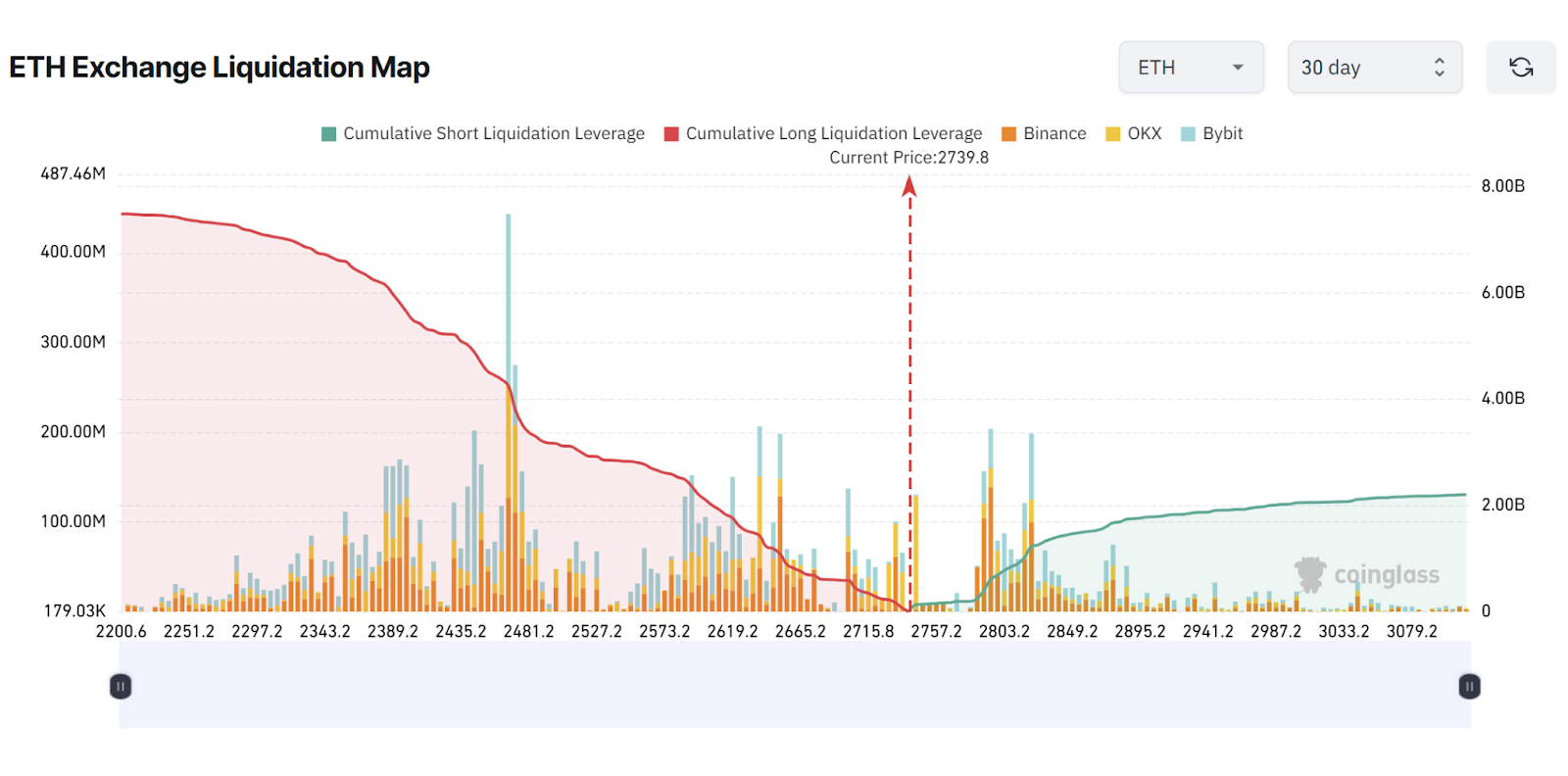

Ethereum Liquidation Chart. Source: CoinGlass

CoinGlass' liquidation heat map reveals the cruel logic of capital games:

- **Long Trap Zone**: $2 billion in forced liquidation risks accumulate between $2,600–$2,665, coinciding with the 50% Fibonacci retracement level of the 2024 bull market.

- **Short Graveyard**: $1.8 billion in short positions hang by a thread above $2,900, corresponding to the historical low ETH/BTC exchange rate of 0.019.

- **Institutional Duality**: CME Ethereum futures account for 9% of open interest, contrasting with the 24% institutional dominance in Bitcoin futures—hinting that traditional capital remains on the sidelines.

The deformed prosperity of the derivatives market is a reflection of a liquidity trap. When the perpetual contract funding rate stays negative and the taker buy-sell ratio drops below 1, the market enters an "extreme bearish" state. In this environment, whales cashing out via OTC resembles a离场信号 (exit signal) before the doomsday carnival—after all, historical data shows a 68% probability of black swan events within 3 months of record open interest.

**Chapter 4: Technical Code and Macro Variables**

From a K-line perspective, hidden mysteries lurk in the current market:

- **Volatility Squeeze**: Daily Bollinger Bands have narrowed to 5%, the lowest since February 2024, indicating an imminent breakthrough.

- **Weekly Paradox**: Price stands above the 50-week and 100-week EMAs, but MACD histograms show a bearish divergence, and an RSI of 42 suggests insufficient upward momentum.

- **Fibonacci Shackles**: A daily close above $2,800 will be the bull-bear watershed. A breakthrough could open theoretical space to $3,200–$3,500, while a reversal may retest $2,500 for support.

On the macro level, U.S.-Russia geopolitical negotiations and Federal Reserve rate cut expectations pose dual disturbances. CME interest rate futures show a 79% pricing for 2–3 rate cuts in 2025; if the actual path deviates, the crypto market will bear the brunt. Standard Chartered warns that if the RWA (Real World Assets) narrative fails to materialize in Q3, Ethereum could face a risk of $100 billion in market cap evaporation.

**Epilogue: On the Eve of a Paradigm Revolution**

Ethereum stands at a historical crossroads:

- **Reconstructing the Staking Economy**: EIP-7251 raises the validation node staking cap to 2,048 ETH and optimizes the exit mechanism to ease liquidity crises.

- **Layer2 Value Feedback**: Mandating Layer2s like Arbitrum to distribute part of their transaction fees to the mainnet solves the paradox of "ecological prosperity, mainnet anemia."

- **Regulatory Breakthrough**: If the SEC approves the 21Shares staking ETF in Q3, it could bring a 15–20% short-term rally and lock up 8% of circulation.

As Peter Brandt noted, after breaking through the $2,800 congestion pattern, Ethereum may launch a "moonshot" to $5,232. But beware: the essence of this capital game remains a liquidity hunt driven by leverage—when $1.8 billion in short positions become fuel, the market will ultimately reveal who is riding the trend and who is swimming naked.

**Disclaimer**: The views in this article represent only the author’s personal opinions and do not constitute investment advice from this platform. This platform makes no guarantees regarding the accuracy, completeness, originality, or timeliness of the article’s information, nor does it assume responsibility for any losses incurred from using or relying on the article’s information.

Contact: Sarah

Phone: +1 6269975768

Tel: +1 6269975768

Email: xttrader777@gmail.com

Add: 250 Consumers Rd, Toronto, ON M2J 4V6, Canada