X-trader NEWS

Open your markets potential

Why is Goldman Sachs’ judgment on Ethereum wrong?

**By: Brendan on Blockchain**

**Compiled by: (Plainspoken Blockchain)**

A few years ago, Ethereum was still Bitcoin’s "sidekick," known for decentralized finance (DeFi), pixelated NFTs, and creative smart contract experiments—hardly a choice for "serious" investors. By 2025, however, Ethereum has become the focus of Wall Street.

In 2021, Goldman Sachs perfectly embodied traditional institutions’ mindset when it dismissed Ethereum as "too volatile and speculative," calling it a "solution in search of a problem." Its research team argued that smart contract technology was overhyped, with limited real-world applications, and that institutional clients had "no legitimate use cases" for programmable money. They were not alone: JPMorgan Chase called it a "pet rock," and traditional asset managers avoided it entirely.

Yet this view is as outdated as dismissing the internet as a "fad." Today, Goldman Sachs is quietly building Ethereum-based trading infrastructure. JPMorgan processes billions of dollars in transactions through its Ethereum-powered Onyx platform. Asset managers who once shunned it are now launching Ethereum-related products as fast as possible.

The real turning point came in 2024, when the U.S. Securities and Exchange Commission (SEC) finally approved a spot Ethereum ETF. This might not sound like an exciting dinner-table topic, but its significance is enormous. Unlike Bitcoin, which is easily categorized as "digital gold," Ethereum posed a puzzle for regulators: How to regulate a programmable blockchain that supports everything from decentralized exchanges to digital art markets? The fact that they solved this and gave the green light speaks volumes about the industry’s trajectory.

### The ETF Floodgates Open

For years, regulatory clarity around Ethereum was uncertain, particularly the SEC’s ambiguous stance on whether Ethereum qualifies as a security. But the ETF approval sends a pivotal signal: Ethereum has matured into an investable asset for pensions, asset managers, and even conservative family offices.

BlackRock led the charge with the iShares Ethereum Trust, and frankly, watching the launch was like witnessing institutional FOMO (fear of missing out) in real time. Fidelity followed suit, Grayscale converted its existing product into an ETF, and suddenly, every major asset manager had an Ethereum offering. What’s more striking is that these products aren’t just plain-vanilla ETFs tracking ETH prices—some incorporate staking rewards, meaning institutional investors can earn yields on their holdings, just like DeFi participants.

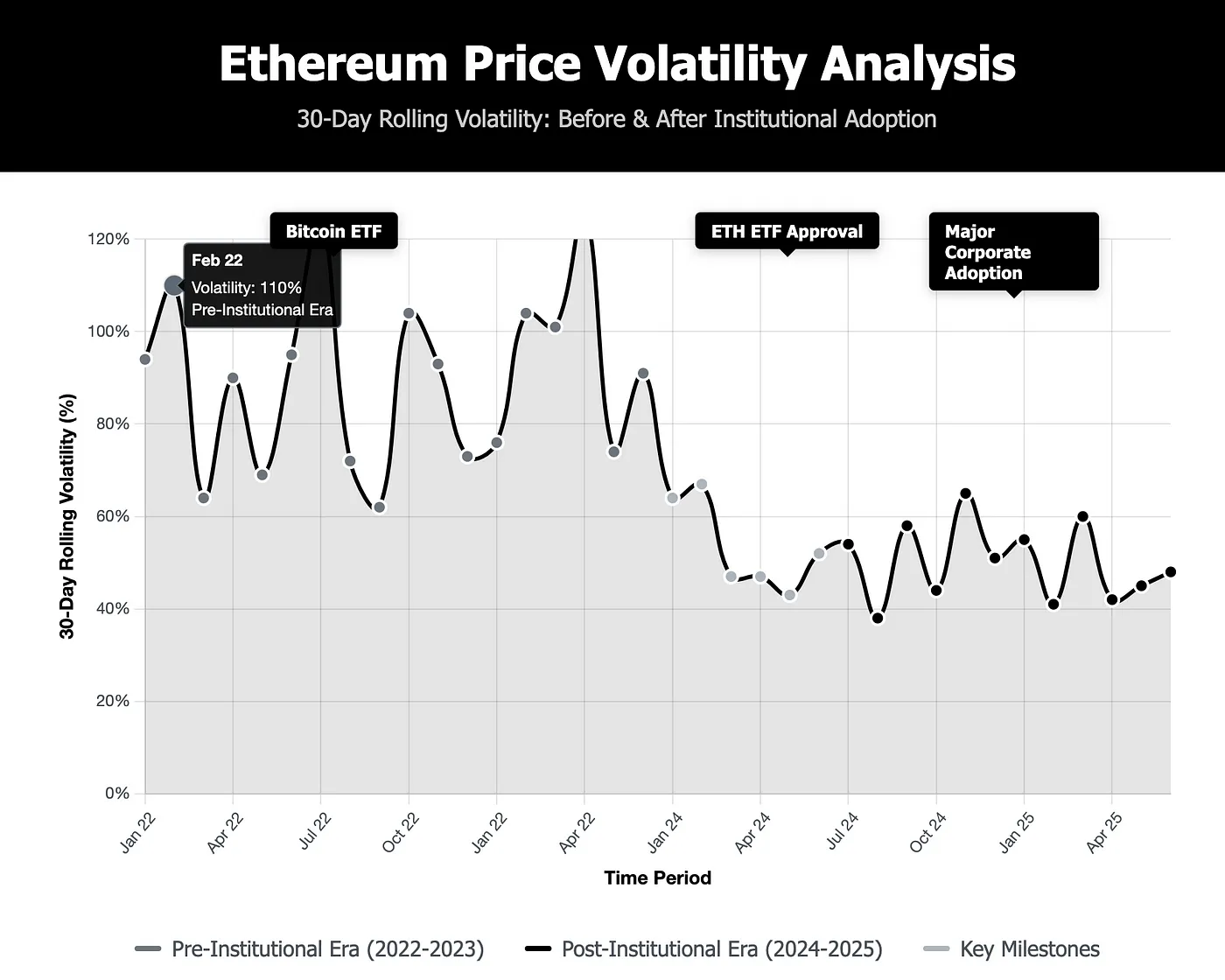

### Institutional Adoption: Before and After

*(Visualization of Ethereum’s price volatility before and after institutional adoption)*

### Enterprises Embrace Ethereum En Masse

The truly fascinating story is how enterprises are integrating Ethereum into real-world operations. This isn’t about holding speculative assets like Bitcoin; it’s about building digital infrastructure on Ethereum to solve practical problems.

Ethereum’s true value to institutions lies in its role as a programmable blockchain infrastructure capable of handling tokenized money, digital contracts, and complex financial workflows.

Institutions are rapidly joining the wave:

- **Franklin Templeton**, a $1.5 trillion asset manager, has tokenized one of its mutual funds on Ethereum. Investors now hold digital shares on the blockchain, enjoying transparency and 24/7 settlement.

- **JPMorgan Chase**, via its blockchain arm Onyx, uses Ethereum-compatible networks (like Polygon and its enterprise Ethereum Quorum) to test tokenized deposits and asset swaps.

- **Amazon AWS** and **Google Cloud** now offer Ethereum node services, allowing enterprises to plug into the network without building infrastructure from scratch.

- **Microsoft** is partnering with **ConsenSys** to explore enterprise use cases, from supply chain tracking to compliance-driven smart contracts.

This is no longer the domain of crypto natives. Traditional financial giants are waking up to the fast, secure, and automated中介-free (intermediary-free) financial services Ethereum offers.

The conversation among Fortune 500 CFOs has shifted entirely. They no longer ask if blockchain makes sense—they ask how to deploy smart contract automation for vendor payments, supply chain financing, and internal processes as quickly as possible. The efficiency gains are undeniable.

The gaming and entertainment industries are particularly aggressive. Mainstream game studios are tokenizing in-game assets, music platforms are automating royalty distributions, and streaming services are experimenting with decentralized content monetization. Ethereum’s transparency and programmability have solved decades-old problems in these industries almost overnight.

### Why Ethereum Appeals to Institutions

Ethereum allows assets—whether dollars, stocks, real estate, or carbon credits—to be digitized, tokenized, and programmed. Combined with stablecoins (like USDC or USDT), which primarily run on Ethereum, it suddenly provides the building blocks for a new financial operating system.

Need cross-border instant settlement?

Programmable payments tied to contract milestones?

Transparency without losing control?

Ethereum does all this and more.

Add Layer 2 networks like Arbitrum and Optimism, and these solutions scale Ethereum’s capacity, reduce fees, and boost speed significantly. Many institutions choose to build on Layer 2 for efficiency while leveraging Ethereum’s liquidity and security.

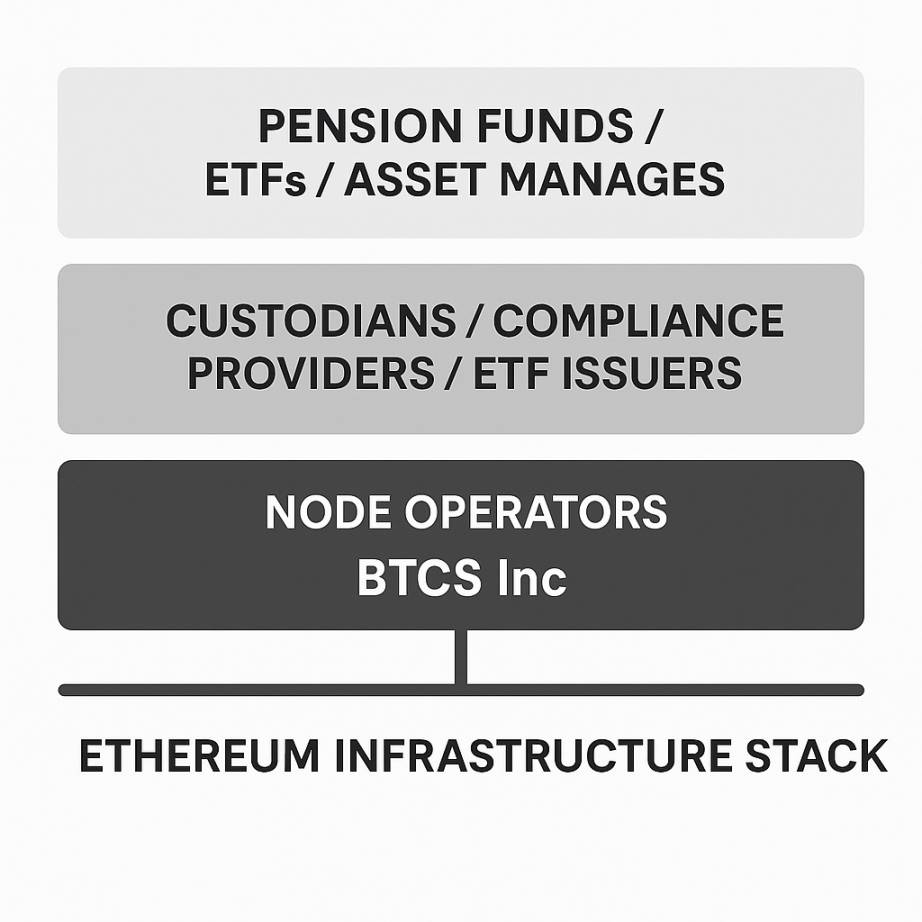

A critical but overlooked infrastructure layer enables this institutional adoption. Companies like **BTCS Inc** are increasingly supporting traditional financial institutions in accessing Ethereum and products like ETH ETFs. BTCS specializes in operating secure, enterprise-grade Ethereum validation nodes, maintaining network integrity and allowing institutions to participate in staking without grappling with technical complexities. While not custodians or ETF issuers, their node operations underpin Ethereum’s functionality and credibility, enhancing the network resilience and transparency that institutional investors demand.

### Looking Ahead

What’s next? The direction is clear: Ethereum is becoming the infrastructure layer for programmable finance. We’re no longer just talking about crypto trading—we’re talking about automated lending, programmable insurance, tokenized real estate, and round-the-clock supply chain financing.

Integration with central bank digital currencies (CBDCs) is another massive opportunity. As nations formulate digital currency strategies, many are exploring Ethereum-compatible solutions to enable seamless interaction between government-issued digital currencies and the broader DeFi ecosystem.

More importantly, this institutional embrace is driving the long-awaited regulatory clarity the industry needs. When major financial institutions build products around Ethereum, regulators have a strong incentive to craft workable frameworks rather than impose blanket restrictions.

We’re witnessing a technology that began as an experimental platform evolve into critical financial infrastructure. The ETF approval is significant, but it’s just the opening act. The real story is how Ethereum is fundamentally reshaping how financial services operate, how enterprises manage their operations, and how value flows in the global economy.

Frankly, we’re still in the early stages of this transformation. Current institutional adoption is merely the beginning of a massive convergence between programmable money and traditional finance.

**Disclaimer**: The views expressed in this article are solely those of the author and do not constitute investment advice on this platform. This platform makes no guarantees regarding the accuracy, completeness, originality, or timeliness of the information and shall not be liable for any losses arising from the use of or reliance on the article’s content.

Contact: Sarah

Phone: +1 6269975768

Tel: +1 6269975768

Email: xttrader777@gmail.com

Add: 250 Consumers Rd, Toronto, ON M2J 4V6, Canada