X-trader NEWS

Open your markets potential

Conversation with Bittensor founder Jacob: Using Bitcoin mining mechanism to reconstruct the AI economy, Chinese developers have become the core force of subnet competition

# Guest: Jacob Robert Steeves, Founder of Bittensor

# Interviewers: Zhou & Chilli, ChainCatcher

In recent years, decentralized artificial intelligence (AI), as a cutting-edge field integrating blockchain and AI technologies, has attracted the attention of the global tech community. Bittensor (TAO), an open-source protocol, applies Bitcoin-style "mining incentive" mechanisms to AI computing. It organizes multiple types of subnets (for inference, training, etc.) and suppliers on the blockchain to compete, with rewards distributed based on their contributions.

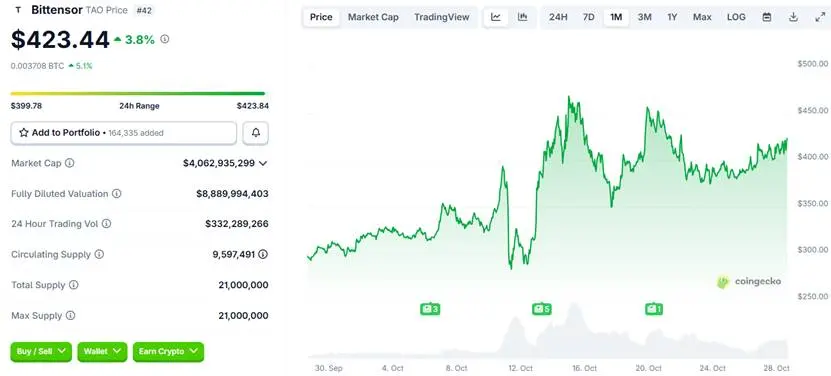

According to CoinGecko data, Bittensor’s token TAO was listed on exchanges in March 2023. As of press time, its price stands at $423, with a market capitalization of approximately $4 billion, ranking 42nd among cryptocurrencies. Recently, TAO Synergies Inc., the treasury company of TAO, announced the completion of a $11 million private placement, with investors including James Altucher (TAO’s strategic advisor) and DCG (the parent company of Grayscale).

In this exclusive interview with ChainCatcher, we are honored to speak with Jacob Steeves, founder of Bittensor, to delve into his technical vision, his journey from Google to entrepreneurship, and how Bittensor breaks the barriers of traditional AI through "incentivized computing."

## From Google to Decentralized AI: Bittensor Applies Mining to AI

**ChainCatcher**: In recent months, we’ve noticed that Bittensor (TAO) has gained strong attention in the U.S. and is rapidly gaining momentum in Asian communities. Through this conversation, we hope to help more readers understand Bittensor and your thoughts on the future of "decentralized AI." Let’s start with your background—many readers know you worked as a software engineer at Google. Why did you leave Google to start a business? What was the most impactful part of that experience?

**Jacob**: I studied mathematics and computer science at Simon Fraser University in Vancouver, Canada. After graduation, I joined a DARPA contractor to work on brain-computer interface chips. My mentor (also the company’s founder) was an early Bitcoin supporter; he introduced me to concepts like "energy/thermodynamic computing" and helped me truly understand Bitcoin.

Since 2015, I’ve deeply engaged in both Bitcoin and AI—these two fields are naturally compatible. The core of AI lies in the study of feedback loops (e.g., backpropagation, genetic algorithms, reinforcement learning), while Bitcoin is the first programmable economic feedback loop. Later, I joined Google as a machine learning engineer and developed Bittensor in my spare time. I decided to commit to Bittensor full-time in 2018, and its mainnet went live in 2021.

During my time at Google, I witnessed the publication of the paper *Attention Is All You Need* (which introduced the Transformer architecture)—a breakthrough that drove the exponential development of large models like GPT. I also learned a great deal about distributed machine learning practices from frontline teams, such as parameter servers, model parallelism, and data parallelism. These experiences were crucial for building Bittensor’s computing architecture later on.

**ChainCatcher**: Before we continue, could you briefly explain what Bittensor is?

**Jacob**: Certainly. Bittensor is an open protocol that applies Bitcoin-style mining mechanisms to AI: we use programmable economic incentives to organize scattered computing power, models, data, and applications into a fair market. Bittensor is a blockchain with its native token TAO, running approximately 128 subnets. These subnets collaborate and compete around different tasks, including inference, training, reinforcement learning, code agents, storage, and prediction/trading signals.

At its core, AI is a computing problem. Bitcoin has proven that "incentives + competition" can effectively coordinate distributed resources—we simply migrated this primitive to intelligent production.

From a user perspective: Developers can launch or join subnets, contribute models and computing power, and receive continuous incentives based on performance. Demand-side users can purchase services like inference, computing power, AutoML, or prediction signals through the network. In short, Bittensor transforms the "miner—reward—consensus" paradigm into "useful AI supply—market reward—network consensus."

## Engaging Chinese Developers: The Strongest Competitive Ecosystem and a New Source of Supply

**ChainCatcher**: Is this your first time in China? Why did you choose this timing to conduct a tour of speeches in China?

**Jacob**: Yes, this is my first time. I currently live in Peru and have never done an overseas tour before—this trip is specifically to discuss Bittensor in China. First, Bittensor applies Bitcoin mining to AI, and China is one of the fastest-growing (and possibly the strongest) countries in the global AI field. When Bitcoin mining was legal in China, its computing power accounted for over 50% of the global total; even today, China produces 90% of the world’s chips.

I have great respect for China’s technical strength in building such networks. I hope more Chinese developers will participate in constructing the Bittensor network to help us expand its scale.

Bittensor is a decentralized, permissionless, and transparent open network—regions around the world can participate fairly. This serves as a meaningful hedge against today’s highly centralized AI infrastructure. We have already proven feasibility in several areas: introducing GPU resources and model services to the market via subnets, and competing with centralized solutions in terms of price and efficiency. My goal in coming to China is to implement these paths in a larger developer ecosystem.

**ChainCatcher**: During this trip, what key messages do you want to convey to Asian developers and investors? Have you encountered any Chinese projects or communities that left a deep impression on you?

**Jacob**: Yes, there is something. A common saying in the Bittensor community goes: When Chinese miners enter a subnet, competition immediately intensifies so much that many existing participants choose to exit. This is actually completely expected, because China’s competitive intensity is truly remarkable. Starting from the way universities organize and train talent, Chinese teams are among the most competitive in the world—so I believe China and Bittensor are a natural fit.

My main message on this trip is: This is a new, fair economic platform. Chinese engineers, builders, and miners can make truly productive contributions here—with openness, transparency, and fair rules. For specific projects, one of Bittensor’s largest subnets, Affine, is being built by Chinese developers and is becoming one of the most competitive mechanisms in the entire network. I hope to attract more such teams, because the technical skills of engineers here are extremely high—few can match them.

**ChainCatcher**: What do you think of the unique positions of China, Hong Kong (China), and Singapore in Web3 and AI?

**Jacob**: Currently, companies in China, Singapore, and East Asia are leading the trend of open-source AI. Top open-source models like DeepSeek come from Chinese teams; Hong Kong (China) and Singapore offer greater flexibility in compliance and capital, facilitating industrialization and cross-border collaboration. Overall, Asia is pushing "open models + engineering implementation" to the forefront—a combination that decentralized AI badly needs. Additionally, top Chinese universities such as Peking University and Tsinghua University have made significant contributions to academic and intellectual progress.

**ChainCatcher**: You mentioned earlier that Bittensor has approximately 128 subnet projects. Could you talk about resource allocation or the distribution of engineers?

**Jacob**: The top three subnet ecosystem projects are all built by Chinese teams—I think this is very significant. Bittensor is an anonymous platform, but we can confirm that a considerable number of Asian teams and computing power are connecting to it. For example, Lium is a leading subnet providing GPU resources; it has created a permissionless market where anyone can contribute GPU computing power and access such resources through the network. Many Chinese miners have contributed these chips (we can see from the IP addresses of these machines that they are indeed in Asia), and we are bringing these resources to the global market.

**ChainCatcher**: Have you been in contact with any investment institutions recently? There must be many investment funds or companies interested in Bittensor.

**Jacob**: Yes, we frequently receive inquiries from investors who want to participate and purchase TAO. However, I am not directly responsible for these matters—I am just an engineer. The Bittensor network is open, and the market is liquid. Therefore, we recommend that people participate directly in TAO’s secondary market, as we believe this is the fairest way—everyone can enter the market on equal terms. In fact, investment firms often reach out to us, but we prefer that everyone participates in the market fairly.

**ChainCatcher**: Looking ahead, is there a possibility of cooperation between Bittensor and traditional internet giants (such as OpenAI, Alibaba, Baidu, etc.)?

**Jacob**: Yes, it’s possible, but it depends on aligning values. Some centralized labs in the U.S. are likely to have little interest—they prefer to control and consolidate resources, while we emphasize openness and permissionlessness. On the contrary, more open teams like DeepSeek, Kimi, and Moonshot can connect their resources to Bittensor, launch subnets on the network to monetize, and also consume supply from the network.

I think it’s just a matter of time: either they cooperate with us, or they adopt our approach to decentralized training. We would welcome the opportunity to collaborate with Moonshot to build truly decentralized training.

## The Essence of Bittensor: Using Crypto-Economic Incentives for AI Research

**ChainCatcher**: Recently, you mentioned on X (formerly Twitter) that "Crypto + AI" is a superficial term—the truly important concept is "incentive computing." Many people understand Bittensor as an "AI model aggregator," but you seem to emphasize it more as an "incentivized network." Could you explain to our readers: What is the biggest difference between Bittensor and traditional aggregation platforms? What exactly has its "decentralization" changed?

**Jacob**: The understanding of Bittensor as an "AI model aggregator" is incorrect. Bittensor’s core is embedding "programmable incentives" into the AI learning process: those who provide more useful inference, training, or tools receive more rewards—which is entirely different from "piling models together."

Over the past 15 years, AI breakthroughs have come from adaptive learning based on feedback/rewards (e.g., backpropagation, reinforcement learning). What we do is directly encode currency and incentives into this mechanism, using market signals to continuously optimize supply and quality.

The significance of "decentralization" lies in permissionless access and resistance to single points of failure. This means any individual/team can launch a subnet to compete; high-quality supply is amplified through incentives, while low-quality supply is naturally eliminated. At the same time, scattered resources and flexible routing make the service more resilient to single-point failures. However, our goal is not "decentralization for the sake of decentralization," but to use incentives to scale useful computing—this is the fundamental difference between Bittensor and traditional aggregation platforms.

That said, the so-called "Crypto + AI"—which either applies cryptocurrency to AI or AI to crypto—does not touch the core of what we are doing. In reality, we are using crypto-economic incentives to conduct AI research.

**ChainCatcher**: A few days ago, AWS experienced a large-scale outage, which disrupted many AI services. How do you interpret this incident?

**Jacob**: I believe this incident demonstrates one value of decentralization: it provides resilience against single points of failure. Bittensor did not experience an outage because we rely on decentralized resource allocation—this is one of our advantages. However, the incident also showed that many so-called decentralized ecosystems are not fully decentralized, as some projects failed to recover after the outage.

Decentralization is not Bittensor’s core goal. While we use censorship-resistant mechanisms in our technical core, this is not the fundamental driving force behind Bittensor.

## Economy and Vision: TAO Halving Cycle, Protocol Revenue Sources, Prediction Markets, and Five-Year Goals

**ChainCatcher**: 2025 will see TAO’s first halving cycle. How do you think this halving will affect the behavior of developers and validators in the ecosystem?

**Jacob**: Actually, I believe the only impact of the halving on Bittensor will be tighter token supply. However, this will not affect the network’s basic incentive mechanism—the network will still have strong economic incentives to encourage developers to build on the platform.

**ChainCatcher**: Where does Bittensor’s protocol-layer revenue mainly come from?

**Jacob**: It mainly comes from selling inference, computing power, and AutoML (automated machine learning), as well as selling signals to prediction markets.

**ChainCatcher**: You mentioned prediction markets earlier. How do you view the current position and business model of prediction markets in the Web3 ecosystem?

**Jacob**: I think prediction markets are a great idea. If you’re referring to platforms like Kalshi and Polymarket, I believe they are among the genuine fintech applications—and the first to target mass consumers. They are highly meaningful and have profoundly changed the way humans work.

**ChainCatcher**: Finally, let’s talk about Bittensor’s vision. Looking ahead five years, what headline about Bittensor would you most like to see? What is your vision for this application, and how do you plan to execute it?

**Jacob**: The most important headline I want to see is: We have brought this technology to "millions" of users, truly providing open intelligent services to the world, and the network continues to expand and operate sustainably.

Right now, we can already see the outline of this path. Economically, we can outcompete centralized providers in many scenarios with cost advantages—especially in inference. Currently, around 100,000 users are using our technology; the next step is to lead not only in inference but also move toward the application layer.

Our goal is to serve billions of users worldwide. Take Ridges as an example: it is one of the larger subnets on Bittensor, focusing on coding agents and jointly optimized by miners globally. A direct benefit of this model is significantly lower prices—the network passively and continuously optimizes cost-performance. While some centralized products have a per-user service cost of nearly $1,000 but can only set a subscription price of around $200 (relying on long-term subsidies), we can offer a $10 subscription with a network cost of approximately $6.

This kind of economic scaling law gives us the ability to reach the global market. If centralized AI companies do not adopt these underlying technical primitives, it will be difficult for them to keep up with us in performance, speed, and cost over the long term.

This is our core advantage. If we can maintain long-term superiority in these key dimensions, they will struggle to compete with us. Conversely, if we fail to do so, we have no ground to stand on.

Similarly, Bitcoin has outperformed sovereign states or centralized systems at the network level because it adopted the right technical primitives and mechanism design. Bittensor has not yet achieved this in all areas, but we have succeeded in some specific fields—and many people already use Bittensor in their daily lives without even realizing it.

## Disclaimer

The views expressed in this article are solely those of the author and do not constitute investment advice from this platform. This platform makes no guarantees regarding the accuracy, completeness, originality, or timeliness of the information in the article, nor does it assume responsibility for any losses arising from the use or reliance on such information.

Contact: Sarah

Phone: +1 6269975768

Tel: +1 6269975768

Email: xttrader777@gmail.com

Add: 250 Consumers Rd, Toronto, ON M2J 4V6, Canada