X-trader NEWS

Open your markets potential

"Gray Trial" to "Belt and Road": Three Destiny of RMB Stable Coin

# I. Testing the Edge of the "Red Line": The Exploration Process of RMB Stablecoins

Before delving into the official intentions, we must first understand a fundamental background: RMB stablecoins are not a new concept, as their exploration has been ongoing in the "gray area" of the market for several years. The key to understanding this lies in distinguishing between two core concepts—onshore RMB (CNY) and offshore RMB (CNH). In short, CNY is the legal tender in mainland China, subject to strict capital controls; while CNH refers to RMB circulating outside China, with a more market-driven exchange rate, providing a natural foundation for the early exploration of stablecoins.

Based on this, nearly all stablecoins that have actually achieved circulation in the current market are pegged 1:1 to offshore RMB (CNH)—Coingecko’s statistics on RMB stablecoins only cover offshore RMB (CNH). Looking back at their development history, we can identify three types of players with distinct backgrounds, each representing a different path of experimentation.

## 1. Tentative Attempts by International Giants

Stablecoin giant Tether and the U.S.-based team TrustToken (now renamed Archblock) launched CNHt and TCNH in 2019 and 2022, respectively. These initiatives were more like strategic tests of a potential market, aiming to facilitate small-scale cross-border payments. However, constrained by the "regulatory wall" in mainland China, they did not invest resources in large-scale promotion. Ultimately, they received a lukewarm response and gradually faded from mainstream view—currently, the combined total market value of the two is only a few million U.S. dollars.

## 2. Failed Endeavors by Mainland Chinese Teams

CNHC, founded by a Chinese team, was once regarded as the most promising competitor in this track and secured investments from star capital firms such as KuCoin Ventures, members of Circle’s founding team, and IDG. Yet just as the project was gaining momentum, its Shanghai office was raided by the police in May 2023, core team members were taken away, and the project came to an abrupt halt. This incident also became a landmark example of mainland China’s strict regulation of crypto-related businesses.

## 3. A Roundabout Breakthrough Under the "Belt and Road" Initiative

After the CNHC incident, AnchorX—a Hong Kong fintech company jointly incubated by Conflux and Hony Capital—was established. It is reported that AnchorX’s core team has close ties to CNHC. The company chose a more circuitous path: in February 2025, it took the lead in obtaining a "fiat-backed stablecoin issuance" license in Kazakhstan, focusing on cross-border trade settlement along the "Belt and Road" routes in Central Asia, and has currently launched sandbox testing.

### Summary of Offshore RMB (CNH) Stablecoin Cases

RMB Stablecoins

**Data Sources**: Coingecko, CoinMarketCap, Token Radar

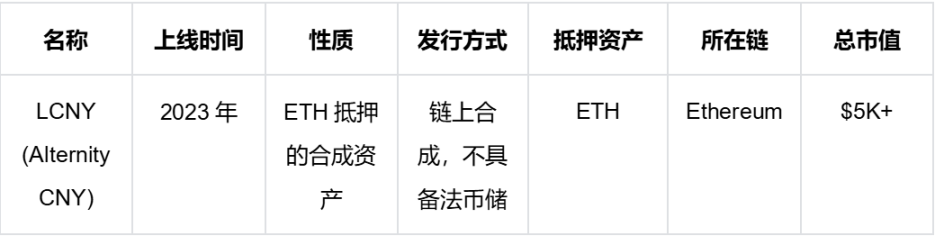

While the exploration of offshore markets has gone through ups and downs, attempts to develop onshore RMB (CNY) stablecoins remain almost a barren wasteland. A handful of projects such as LCNY and bitCNY are essentially synthetic assets generated by collateralizing crypto assets, rather than being backed by real fiat currency reserves. The logic behind this is quite clear: under China’s strict foreign exchange control system, any fiat-backed stablecoin directly pegged to onshore RMB would be equivalent to openly challenging the country’s core financial defense lines.

### Summary of Onshore RMB (CNY) Stablecoin Cases

RMB Stablecoins

RMB Stablecoins

**Data Source**: Defilama

These attempts, with varying degrees of success and failure, collectively outline the realistic landscape of RMB stablecoin development and reveal several clear inherent laws behind it:

1. "Offshore" is the only viable path, while "onshore" remains a red line. All effective attempts have been concentrated in the CNH field. This clearly indicates that in the foreseeable future, any official or semi-official projects will be strictly confined to the offshore market to ensure risk isolation from the domestic financial system.

2. Feasibility has been verified, but large-scale adoption poses a huge challenge. Both technological implementation and small-scale pilots have proven that issuing RMB stablecoins is not difficult. However, the current total market value of RMB stablecoins—only a few million U.S. dollars—pales in comparison to the hundreds of billions of U.S. dollars of USD stablecoins. Finding real, large-scale application scenarios is the key to determining whether RMB stablecoins can rise to prominence.

3. The strategic focus is shifting from "globalization" to "geopoliticization." If early projects still held a vague vision of serving the global market, the launch of AnchorX in Kazakhstan marks a major shift in strategic direction: serving specific geopolitical and economic goals such as the "Belt and Road Initiative" is becoming the most practical application scenario for RMB stablecoins.

# II. Opportunities and Challenges: Three Core "Interrogations" Behind the Grand Narrative

Against this backdrop, the concept of RMB stablecoins undoubtedly carries enormous strategic opportunities. It is not only expected to build a "Digital Silk Road" independent of SWIFT for "Belt and Road" trade, reshaping the regional settlement system; but also to compete with USD stablecoins in the global crypto economy and strive for "seigniorage" in the digital era. This is precisely the core driving force behind the official willingness to reevaluate the possibility of RMB stablecoins.

However, beneath the grand narrative, three core practical issues lie ahead. These are not only three "interrogations" that must be answered, but also key obstacles that must be cleared before stablecoin issuance.

## The First Interrogation: How to Balance Monetary Innovation and Financial Stability?

Even for offshore RMB stablecoins, their capital flows will eventually be inextricably linked to the onshore system. How to encourage innovation and expand the international influence of the RMB while ensuring that stablecoins do not become a "Trojan horse" for capital outflows? How to build effective mechanisms for risk isolation and regulatory penetration? These questions are like the "Sword of Damocles" hanging over all practitioners.

## The Second Interrogation: How to Break Through the Bottleneck of Insufficient Reserve Assets?

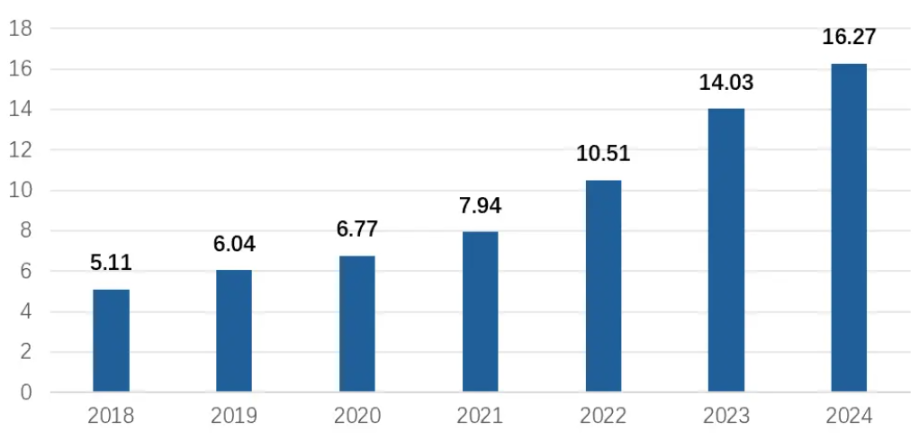

A core contradiction emerges: the potential demand for RMB stablecoins is huge, but qualified reserve assets are extremely scarce. Professor Fang Xiang from the University of Hong Kong recently quantified this issue in an article: Based on the 16 trillion yuan of cross-border RMB settlement volume in 2024, assuming only 20% of this shifts to stablecoin settlement and using the currency circulation velocity of USD stablecoins (6.8) as a reference, the required scale of RMB stablecoins would exceed 400 billion yuan. However, the problem is that by the end of 2024, the total amount of high-quality short-term offshore RMB bonds available for use was only tens of billions of yuan. This supply-demand gap of more than ten times is an unavoidable practical bottleneck in the development of RMB stablecoins.

RMB Stablecoins

**Data Source**: People's Bank of China (PBOC) *Financial Statistics Data Report*; Chart created by the author

## The Third Interrogation: How to Break the Monopoly of USD Stablecoins?

After years of development, USD stablecoins have established a massive user base, deep liquidity, and a mature ecosystem worldwide. Newly emerging offshore RMB stablecoins not only need to build user trust from scratch but also confront formidable network effect barriers. Persuading global users and developers to "abandon USD and adopt RMB" will be an extraordinarily arduous battle.

# III. "Tacit Approval" and "Expedition": The Future Roadmap for RMB Stablecoins

Regardless of whether the rumors are true, amid such a complex situation, one thing is foreseeable: the official strategy will never be a simplistic and heavy-handed "full liberalization," but rather a prudent and sophisticated "combination of measures." Its strategic path can generally be understood from the following three dimensions:

First, in terms of official attitude, a shift is taking place from "strict prohibition" to "tacit approval first + timely guidance." From the industry’s "open secret" that merchants in Yiwu now commonly use USDT, to the AnchorX team traveling to Central Asia to obtain compliance licenses, these seemingly isolated events all point to subtle changes in regulatory attitudes: for explorations that serve national strategies, the approach is shifting from strict blocking to observation and even tacit approval. The recent rumors of deliberations may well mark the top leadership’s intention to formally incorporate these "gray-area explorations" into a more macro and controllable top-level design.

Second, in terms of issuance strategy, a concept akin to "building a public thoroughfare in the open while sneaking through a hidden path" may emerge. Hong Kong will serve as the "public thoroughfare" that attracts global attention—as an officially recognized pilot, it will conduct limited sandbox tests. However, the true linchpin of the policy lies in the "hidden path" along the Belt and Road Initiative: encouraging compliant teams to obtain licenses in friendly countries, and through a model of "one license to serve the globe," laying down compliant "landing points" for the RMB’s global "expedition."

Third, in terms of long-term goals, the aim is to build a "new cross-border infrastructure for digital finance." Issuing stablecoins is only the first step; in fact, the long-term goal of the Chinese government has always remained unchanged: to create a global cross-border payment network independent of SWIFT—only now, the underlying technology has shifted from traditional architecture to blockchain. It is foreseeable that in the future, not only will more public blockchains with official backgrounds emerge, but they will also be deeply integrated into the trade networks of the Belt and Road Initiative, connecting with the central bank and commercial banking systems of countries along the route. Ultimately, this will consolidate into a high-efficiency regional trade settlement ecosystem centered on the RMB, with multi-currency synergy.

# IV. Conclusion

As the issuance of Hong Kong Dollar (HKD) stablecoins is already on the agenda, and offshore RMB stablecoins are quietly being piloted in Central Asian trade scenarios, the re-examination of this field by mainland China is both logical and particularly urgent. Whether Reuters’ news is groundless speculation or an intentional "leak" by the authorities, we still do not know for certain. However, one thing is clear: discussions about RMB stablecoins have moved from behind the scenes to the forefront. As for how the final policies will be implemented—especially the clear definition of the "red line" between "onshore" and "offshore"—this will not only determine the future form of the digital RMB but also serve as a crucial window to observe China’s strategic ambitions amid the new round of global financial transformation.

### Disclaimer

The views expressed in this article are solely those of the author and do not constitute investment advice for this platform. This platform makes no guarantees regarding the accuracy, completeness, originality, or timeliness of the information contained in the article, nor shall it be liable for any losses arising from the use of or reliance on such information.

Contact: Sarah

Phone: +1 6269975768

Tel: +1 6269975768

Email: xttrader777@gmail.com

Add: 250 Consumers Rd, Toronto, ON M2J 4V6, Canada