X-trader NEWS

Open your markets potential

The future of MSTR, mNAV and Bitcoin treasury reserves

Author: On-Chain Mind

Compiler: Shaw, Jinse Finance

In the financial world, there are concepts that most of us accept without truly questioning—such as the price-to-earnings ratio, the "fair value" metric, or even the assumption that the value of money itself remains stable. But when you step back, some of these ideas start to look less like unchangeable laws of nature and more like collective beliefs propped up by tradition.

This article delves into Strategy (MSTR), the concept of market capitalization-to-net asset value ratio (mNAV), and how these ideas fit into the evolving world of companies centered around Bitcoin. It offers a more fundamental and philosophical perspective on this new type of company, connecting familiar concepts from traditional finance (TradFi) while challenging assumptions many investors take for granted.

By the end, you’ll understand that companies like MSTR aren’t just "buying Bitcoin"—they’re reshaping what stock value might look like over the next decade.

Let’s begin.

### Key Takeaways

- **Challenging traditional metrics**: Free cash flow per share (FCF/Share), the "North Star" of traditional stock investing, bears striking similarities to Bitcoin per share in companies holding Bitcoin reserves.

- **The power of growth narratives**: Investors bet on long-term growth despite uncertainties, aligning with Bitcoin’s exceptional compounding rate.

- **mNAV as the "new P/E ratio"**: It’s not just a valuation tool but a reflection of operational strength, financing capabilities, and investor confidence in Bitcoin holdings.

- **MSTR’s technical signals**: Indicators like the 200-day moving average and Z-score probability waves suggest the company’s current price of around $350 is an attractive entry point.

### FCF/Share: The North Star of Traditional Investing

If we simplify the essence of stock investing, one metric stands out: free cash flow per share (FCF/Share).

Why? Because free cash flow represents the actual cash a company generates after covering operating expenses and capital investments.

FCF/Share is often seen as the ultimate measure of a stock’s effectiveness in returning capital to shareholders—whether through dividends, buybacks, or reinvestment. A consistent 15% annual growth in FCF/Share is typically called "excellent" because, at that compound rate, stock value roughly doubles every 5 years—a feat few companies worldwide can sustain.

This is why the market awards such companies premium valuations, usually with P/E ratios between 25 and 30. In some cases, investors even accept P/E ratios over 100. At first glance, this seems absurd—many companies won’t survive long enough to deliver expected returns. But the reasoning is simple: growth. If the story is compelling enough, investors will pay a premium.

### The Madness of High P/E Ratios

Willingness to pay extremely high P/E ratios for earnings is one of the widely accepted quirks of investing. Few stop to question why. But stepping back, people are essentially betting on an unknowable future.

- Will the company exist in 25 years?

- Will it remain dominant in its industry?

- Will earnings growth compound without interruption?

Despite these uncertainties, the narrative of growth itself becomes a form of currency. The market treats it as dogma.

The reason: If enough people believe in a company’s growth, that belief can drive its stock price higher for years. This concept is widely accepted in investing, but when you break it down and think philosophically about what’s really happening, it’s quite疯狂.

### The Rise of mNAV

Now, apply this logic to Bitcoin treasury reserve companies. The same concept is playing out in the world of Bitcoin-reserving firms. mNAV (market cap to net asset value ratio) is the "premium" investors pay for a company to acquire more Bitcoin in ways they couldn’t efficiently achieve on their own.

I like to think of it as the "new era" price-to-earnings (P/E) ratio. In reality, it’s conceptually closer to the price-to-book (P/B) ratio, though that term is less familiar to average investors. Interestingly, the S&P 500 currently has a P/B ratio of about 5.4, with a historical range of 1.5 to 5.5—strikingly similar to MSTR’s historical average mNAV.

The P/B ratio measures the relationship between a company’s market cap and its book value (assets minus liabilities). It shows how much investors pay for each dollar of net assets.

It’s refreshing to see many investors question why we pay a premium for underlying Bitcoin assets, rather than blindly accepting the concept as with many aspects of traditional finance. We should ask why things are priced the way they are. I see this as a huge advantage for ordinary Bitcoin investors: the ability to challenge ideas widely accepted simply because "that’s how it’s always been done."

### Why Does the Bitcoin Premium Exist?

- **Trust in growth plans**: Companies will find ways to grow their asset portfolios faster than individuals.

- **Access to cheap capital**: A benefit ordinary investors can never match.

- **Operational leverage**: Using structures like convertible bonds or equity financing to expand faster.

Can you get a loan at roughly 0% interest to accumulate more Bitcoin? Almost certainly not. This is the strength of the best Bitcoin reserve companies—especially larger, committed ones like Strategy (MSTR).

Specifically, companies like MSTR use convertible bonds, where lenders accept lower interest rates in exchange for the right to convert to equity. This effectively subsidizes Bitcoin accumulation. In TradFi, this is similar to how tech growth companies use leverage to scale without immediately diluting equity.

But if a 15% annual growth rate in FCF/Share for traditional stocks is considered "exceptional," why do we value Bitcoin-holding companies like MSTR at a 1.5x premium (or 4-5x) when Bitcoin has compounded at 60-80% annually over the past 5-10 years?

I believe this is a key concept the broader investment community hasn’t grasped. They still largely fail to recognize that Bitcoin is a top-five global asset gradually absorbing global capital value. This is a major reason I’m long-term bullish on companies like MSTR.

### mNAV Discounts: Traps and True Signals

Can companies trade at an mNAV below 1? Absolutely. According to Bitcoin Treasuries, 21 out of 167 publicly traded companies (about 13%) currently trade at a discounted mNAV.

This mirrors why some stocks trade at extremely low P/E ratios, like 5x. Many TradFi investors fall into this "value trap," thinking they’re getting a bargain because the stock price is low. But in reality, stocks are usually cheap because the company has failed to meet investor expectations.

I believe the concept of value traps applies to Bitcoin reserve companies too. For firms trading at a discounted mNAV, this signals market skepticism, possibly tied to:

- Weak governance;

- Fragile financing models;

- Operational risks in current business.

Ironically, it might also indicate investor confidence in these companies’ ability to hold Bitcoin. Mathematically, when mNAV is below 1, it would actually benefit shareholders for the company to sell Bitcoin and repurchase stock.

But companies like MSTR resist this temptation. Even during the 2022 bear market, when its mNAV dipped below 1, it restructured debt to retain all Bitcoin holdings. This is why I’m confident MSTR won’t fall into this category. I have no doubt it will continue holding all its Bitcoin even in adverse conditions. This long-term holding philosophy stems from Michael Saylor’s vision of Bitcoin as pure collateral.

I’m less confident in the other 166 public companies. The only other firm I’d classify as "HODL (long-term holding)" is Japan’s Metaplanet.

Thus, mNAV isn’t a simple buy or sell signal—it’s a perspective. A premium might indicate strong confidence or just hype, while a discount could reflect distress or hidden value. The key lies in specifics:

- How fast is the company growing its Bitcoin per share?

- Does it have other revenue streams to support valuation?

- How resilient is its funding model across market cycles?

### MSTR’s Financial Magic

What truly sets MSTR apart from other Bitcoin reserve companies is its diverse fiat financing capabilities, which effectively fund its Bitcoin acquisitions. Its low-cost financing tools—like convertible bonds—and expanding list of preferred stock issuances allow it to grow Bitcoin holdings faster without diluting common MSTR shareholders.

For example, convertible bonds enable borrowing at near-zero effective interest rates when converted to equity during bull markets. This creates a flywheel: more Bitcoin boosts collateral value, allowing more borrowing. In my view, this financial magic deserves a significant premium. Just as NVIDIA earns a justified P/E ratio in TradFi for growing FCF/Share faster than almost any other company.

To most people, this is entirely new. Bitcoin reserve companies aim to maximize Bitcoin per share growth, while TradFi firms focus on FCF/Share growth. The idea is the same. The difference? One seeks to grow pure capital that appreciates at least 30-50% annually for the foreseeable future; the other tries to accumulate their preferred fiat currency, which loses 8-10% of its value yearly.

I know which strategy is more likely to create more value for shareholders over the next decade.

### Market Signals

Finally, let’s briefly examine some charts for potential value opportunities.

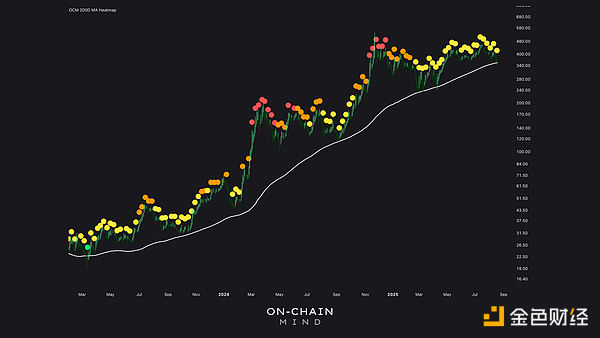

The 200-day moving average signals strength: MSTR is on track to form its second green signal on the 200-day chart in this cycle, trading near the 200-day average of $353. This level is a key support for bulls, marking the start of the current uptrend. Stabilization here could预示 strong upside potential.

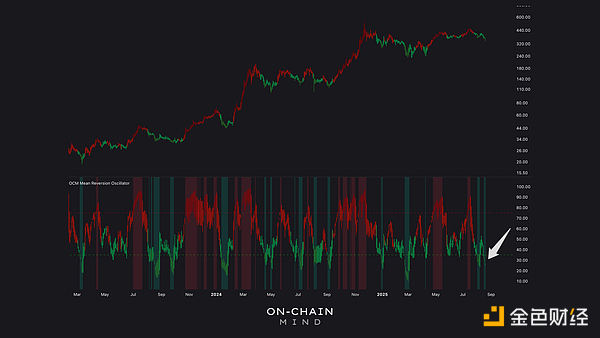

Z-score Probability Wave: MSTR's stock price has dropped to a level of minus 2 standard deviations, which is exactly $353. Historically, in this bull market, when the stock price falls below minus 1 standard deviation, it often indicates that there will be significant price fluctuations. If the macro situation remains optimistic, the stock price is likely to return to the mean.

Oversold Condition: My mean reversion oscillation indicator (which has a similar logic to the RSI Relative Strength Index) shows that MSTR is in a deeply oversold region. In the past, being at this level has often led to short-term rebounds and sometimes even significant upward movements.

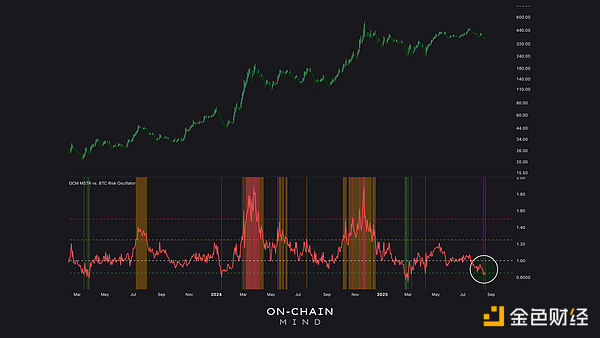

MSTR Investment Opportunity Priced in Bitcoin: When priced in Bitcoin, MSTR's risk oscillation indicator is at one of its lowest values. For investors in a low-tax environment, this is a strong signal to shift investments from Bitcoin to MSTR. Historically, such a lag in MSTR's stock price relative to Bitcoin has usually been quickly made up for.

Why I'm Not Worried About MSTR's Stock Price Lag

In summary, am I worried that MSTR's stock price is lagging behind Bitcoin's current gains? Not at all. The mNAV may have compressed to around 1.5 currently, but the true measure of its Bitcoin strategy remains intact: the number of Bitcoins per share is still increasing every week. To a large extent, this is all I care about.

Just like traditional stocks, their free cash flow per share may increase year by year, but the stock price can fluctuate ups and downs. This is the wonder of irrational investor psychology. However, if the fundamentals continue to improve (such as the increasing number of Bitcoins per share), I will be eager to seize the opportunity to buy the company at a discounted price. Because, as we know, when investor sentiment shifts and the price-to-earnings ratio finally expands again, this stock has the potential to generate substantial profits.

Disclaimer: The views in this article only represent the author's personal opinions and do not constitute investment advice for this platform. This platform does not guarantee the accuracy, completeness, originality, or timeliness of the article information, nor does it assume any responsibility for losses caused by the use or reliance on the article information.

Contact: Sarah

Phone: +1 6269975768

Tel: +1 6269975768

Email: xttrader777@gmail.com

Add: 250 Consumers Rd, Toronto, ON M2J 4V6, Canada