X-trader NEWS

Open your markets potential

New Power of Stable Coins ENA: Value and Risk Behind Highlights

Written by: Apisara Sukhathip, Unlocks Insights

Compiled by: Jinse Finance xiaozou

The Ethena (ENA) project has garnered significant attention after StablecoinX announced the completion of a $360 million funding round and plans to repurchase $260 million worth of ENA tokens (approximately 8% of the total supply) within six weeks. The protocol generates strong revenue ($307 million in the past year) by retaining 20% of USDe's yields, which come from perpetual contract funding rates, ETH staking, and U.S. Treasury yields.

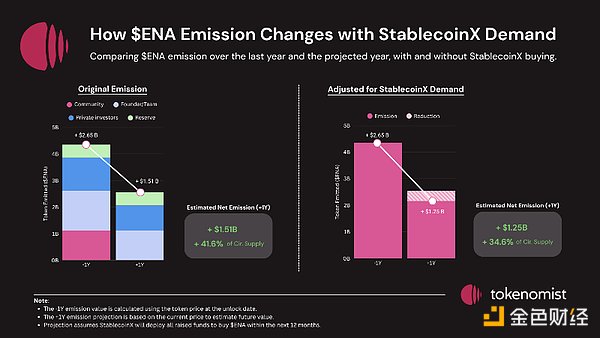

**Bullish Factors**: An approved fee-switch mechanism may distribute a portion of revenue to sENA holders—with a baseline yield of approximately 4% and potential to exceed 10% in a bull market. Other growth drivers include the launch of Converge Chain L2 and the GENIUS Act-compliant stablecoin USDtb. The repurchase will also reduce next year’s net token issuance from 41.6% to 34.6%.

**Risk Warnings**: Over $1.1 billion in private/team tokens will unlock in the next year, with an additional $1.1 billion in "pending" ecosystem funds to be allocated. Compared to other DeFi protocols, ENA has a high token release-to-revenue ratio, and its model has not yet been tested in a prolonged bear market.

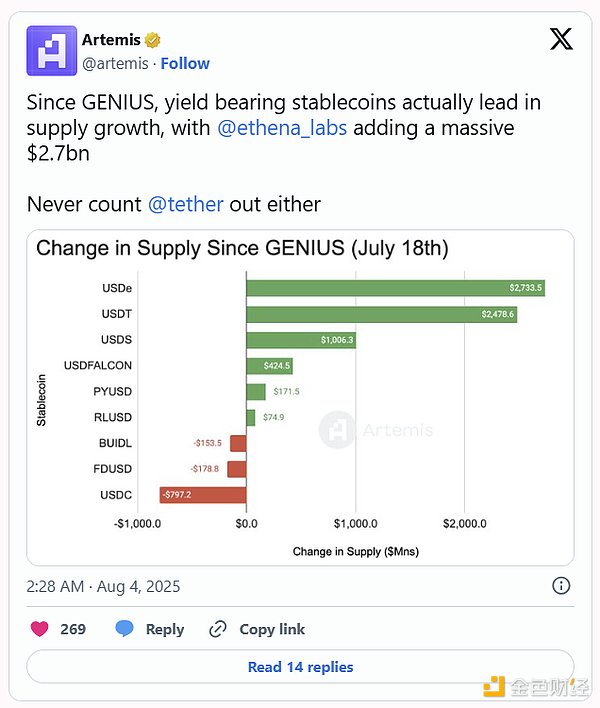

Stablecoins are becoming a cornerstone of the crypto sector, supporting payments, trading, and DeFi. With the GENIUS Act providing a legal framework in the U.S. and Circle’s IPO demonstrating strong investor demand, the industry is entering a new growth phase.

Against this backdrop, Ethena and its token ENA have become focal points. The launch of StablecoinX—modeled after "Strategy" (formerly MicroStrategy)—has made ENA one of the hottest topics on Crypto Twitter.

But hype alone tells only part of the story. This article will delve into ENA’s tokenomics, release mechanisms, and value drivers—highlighting key opportunities and risks for investors:

- Tokenomics Overview: Current Supply Dynamics and Allocation Structure

- Key Catalyst: StablecoinX Funding—$360 Million Raise and Token Repurchase Plan

- Revenue and Value Accumulation Mechanisms: Protocol Economic Model, Fee-Switch Mechanism, and Yield Projections

- Risks and Unlock Pressures: Supply Risks, Release Volume Analysis, and Long-Term Sustainability Concerns

### 1. Tokenomics Overview

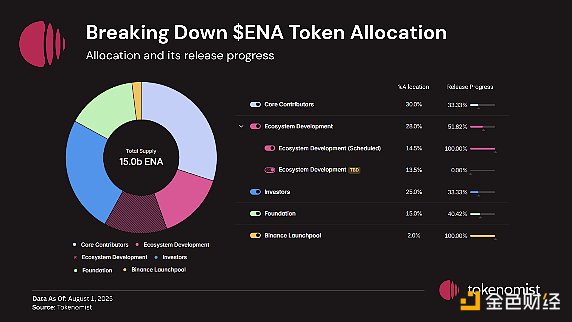

- Total Supply: 15 billion tokens

- Circulating Supply: 6.35 billion tokens (42.36% of total supply)

### 2. Key Catalyst: StablecoinX Funding Plan

Market optimism for ENA has recently surged following a major announcement from Ethena’s newly established financial arm, StablecoinX. StablecoinX disclosed a $360 million dedicated funding plan, with all funds earmarked for acquiring ENA, alongside plans to list its Class A common stock on the Nasdaq Global Market under the ticker "USDE." The round includes a $60 million ENA injection from the Ethena Foundation.

Under the deployment plan, StablecoinX will purchase ENA at an average daily rate of approximately $5 million over the next six weeks. At current prices, the $260 million public market acquisition will account for roughly 8% of ENA’s circulating supply, creating a strong demand catalyst and reigniting bullish sentiment.

With StablecoinX’s planned $260 million ENA repurchase, Ethena’s net token release structure has shifted significantly. As shown in the chart above, ENA’s projected net release over the next 12 months will drop from 41.6% to 34.6% of the circulating supply. This move effectively eases short-term selling pressure and strengthens bullish expectations.

### 3. Revenue and Value Accumulation Mechanisms

Ethena generates protocol revenue by retaining 20% of USDe’s yields, which stem from three main sources:

- Perpetual contract funding rates from delta-neutral positions

- ETH staking yields

- Tokenized Treasury yields (e.g., BUIDL)

The remaining 80% of yields are distributed to sUSDe holders, making Ethena one of the few stablecoin protocols with built-in value accumulation cycles for both users and the protocol treasury. For details, refer to the Ethena documentation.

To date, cumulative protocol revenue has reached $405.8 million, with $306.7 million generated in the past 12 months. However, Ethena’s revenue is highly correlated with market sentiment—funding rates typically rise in bull markets to boost yields but may decline or turn negative in bear markets. This特性 makes Ethena’s revenue model both scalable and tightly tied to market cycles. Given the protocol is still in its early stages and untested in a prolonged bear market, investors should exercise caution.

#### (1) Progress on the Fee-Switch Mechanism

Another catalyst for ENA comes from the fee-switch mechanism, a governance proposal by Wintermute approved by the protocol’s risk committee. Once activated, this mechanism will direct a portion of protocol revenue directly to sENA token holders, establishing a more direct value accumulation channel.

However, activation requires meeting several conditions:

- USDe’s circulating supply exceeds $6 billion

- Cumulative protocol revenue surpasses $250 million

- USDe is listed on at least 4 of the top 5 centralized exchanges by derivatives trading volume

- Reserve fund size reaches 1% or more of USDe’s supply

- Widening the spread between sUSDe’s annualized yield and competitive benchmarks (e.g., Aave’s USDC)

Most benchmarks have already been met. The remaining requirements are expanding the reserve fund and increasing the relative annualized yield spread to strengthen sUSDe’s competitive edge over other stablecoin yield products. Thus, activation of the fee-switch mechanism is imminent and will be a key milestone for unlocking value for long-term ENA holders.

#### (2) Potential Yields for sENA Under Different Scenarios

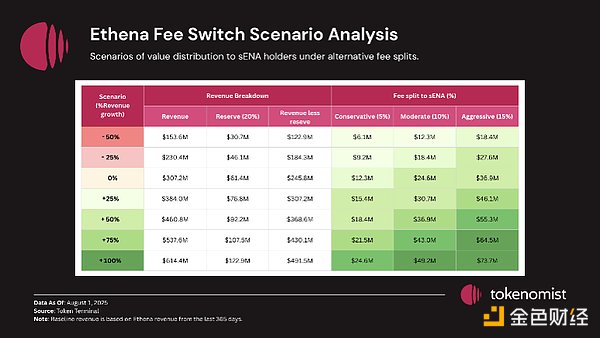

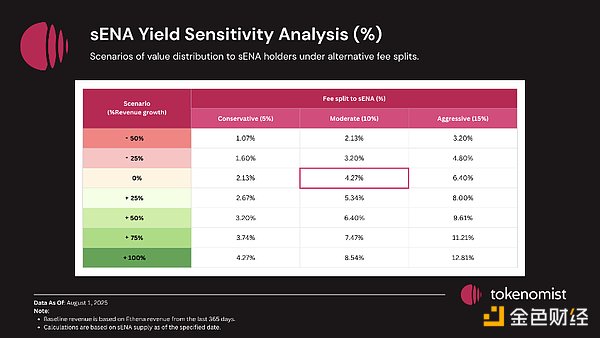

To assess the fee-switch mechanism’s impact on ENA holders, we modeled scenario analyses simulating combinations of protocol revenue growth and fee distribution ratios between sENA/sUSDe holders:

- Annual revenue growth scenarios: -50%, -25%, 0%, +25%, +50%, +75%, +100%

- Fee distribution ratio scenarios: conservative (5%), moderate (10%), aggressive (15%)

The analysis shows that even in a scenario with zero revenue growth and only 10% of fees allocated to sENA, the expected yield still exceeds 4%—already higher than direct ETH staking returns. More optimistic revenue growth assumptions or higher fee分配 ratios would naturally further boost potential returns, making sENA a highly attractive interest-bearing asset once the fee-switch is activated.

It is critical to note, however, that these are hypothetical projections. The actual fee distribution ratio remains undecided, and real-world outcomes will depend heavily on market conditions and governance decisions.

#### (3) Strategic Partnerships and Product Expansion

Beyond its core stablecoin business, Ethena is expanding its ecosystem to create new growth channels and value accumulation sources for ENA holders.

First, the team is developing Converge Chain—an Ethereum Layer 2 network built on Arbitrum. This network will host Ethereal (a native perpetual contract decentralized exchange) and other dApps in the Ethena ecosystem. This move not only opens fee-based revenue streams beyond USDe but also creates new paths for ENA’s value capture.

Second, Ethena Labs has formed a strategic partnership with Anchorage Digital to launch USDtb—the first stablecoin explicitly designed to comply with the GENIUS Act. This collaboration positions Ethena at the forefront of the next phase of U.S. stablecoin adoption and enhances its credibility among institutional investors.

These developments collectively underscore Ethena’s ambitious vision—evolving from a single-product protocol to a multi-revenue-engine ecosystem with stronger regulatory compliance.

### 4. Risks and Token Unlock Pressures

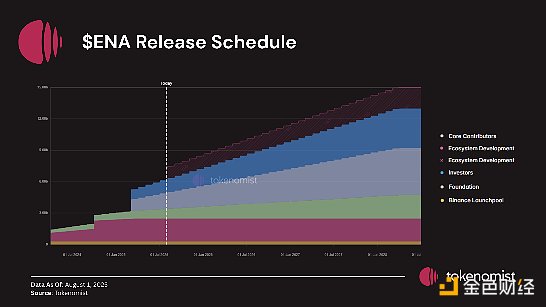

While recent catalysts like the StablecoinX repurchase have eased short-term dilution, investors must remain vigilant about Ethena’s long-term token supply dynamics. Over the next 12 months alone, over $500 million in tokens will unlock for private investors, with an additional $640 million allocated to founding teams and early contributors. These upcoming releases pose significant potential selling pressure, reminding investors not to focus solely on short-term bullish narratives.

Further complicating matters is the uncertainty surrounding Ethena’s large ecosystem development fund allocation. The fourth-quarter airdrop (launched in March 2025) is ongoing, with the first three quarters distributing 2.25 billion ENA tokens (750 million per quarter). As the fourth quarter progresses, an additional 13.5% of the total supply (approximately 2 billion tokens, worth ~$1.1 billion at current prices) is reserved for future ecosystem development—exposing the protocol to over $1 billion in uncertainty. This fund size dwarfs most DeFi treasuries, and its potential dilution could outweigh any fee-switch or repurchase mechanisms, making the timing and deployment strategy of these tokens critical to ENA’s long-term value proposition.

The chart below shows the ratio of token releases to annualized fee revenue (calculated using the protocol’s latest 30-day data). A higher ratio indicates token releases far outpacing fee generation—providing a clear view of how much token value is diluted to generate $1 in revenue. While imperfect, this comparison offers a useful lens for analyzing the sustainability of different protocols.

Against this backdrop, ENA exhibits a higher ratio compared to other major DeFi protocols, reflecting large-scale token unlocks and ongoing supply expansion. Investors evaluating ENA’s long-term investment value should prioritize this dynamic.

### 5. Conclusion

Ethena has quickly emerged as one of the most innovative players in stablecoins and synthetic USD. With strong revenue generation, an expanding ecosystem, and catalysts like the StablecoinX repurchase plan and upcoming fee-switch, the protocol offers substantial value accumulation potential for ENA holders. However, investors should balance optimism with caution. Significant internal token unlocks, reliance on market-dependent revenue, and an untested track record through full market cycles remain key risks. Ultimately, ENA represents both high growth potential in favorable conditions and significant supply risks that must be carefully weighed—both critical considerations in any long-term investment framework.

【Disclaimer】The market is risky, and investment requires caution. This article does not constitute investment advice. Users should consider whether any opinions, views, or conclusions in this article are suitable for their specific situation. Investors shall bear their own responsibilities for investments made based on this article.

Contact: Sarah

Phone: +1 6269975768

Tel: +1 6269975768

Email: xttrader777@gmail.com

Add: 250 Consumers Rd, Toronto, ON M2J 4V6, Canada